[ Return ] [ Entire Thread ] [ Last 50 posts ]

| >> | No. 8631

8631

I think I have a substantial gap in my knowledge that exists somewhere between personal finance and economics. Let me explain: |

| >> | No. 8632

8632

There is no particular route to becoming wealthy, if there was then everyone would do it. You can do a lot of the things you mention to optimise your chances but in the end that's all it is; chance. The right industries to work in varies depending on where and when you are. Sometimes having a niche works, sometimes you have better luck if you diversify. |

| >> | No. 8633

8633

Wealth in this sense comes from earning money from means other than your own labour. |

| >> | No. 8634

8634

>>8632 |

| >> | No. 8635

8635

>>8634 |

| >> | No. 8636

8636

>>8635 |

| >> | No. 8637

8637

fff055c397b6fd0031368fa630bbd08f.jpg

>How do people become wealthy? |

| >> | No. 8638

8638

>>8636 |

| >> | No. 8639

8639

0_Huddersfield-born-Yorkshire-Shepherdess-Amanda-O.jpg

The answer is to marry someone rich and much older than you, proclaim your newfound wealth to be self-made and then call everyone else lazy for not being able to follow your path. |

| >> | No. 8640

8640

>>8636 |

| >> | No. 8641

8641

>>8637 |

| >> | No. 8642

8642

I'm curious how you'd account for factors that involve a risk-reward trade off. |

| >> | No. 8643

8643

>>8642 |

| >> | No. 8644

8644

>>8639 |

| >> | No. 8645

8645

>>8644 |

| >> | No. 8647

8647

>>8645 |

| >> | No. 8648

8648

>>8647 |

| >> | No. 8649

8649

>>8645 |

| >> | No. 8651

8651

>>8649 |

| >> | No. 8652

8652

>>8651 |

| >> | No. 8655

8655

Work in sales. That's the job that pays 100 grand a year with very little effort, if you're good at it. If you're not, then that's a shame because I honestly don't think it's possible to get good at it if you aren't naturally that sort of person. |

| >> | No. 8665

8665

>>8655 |

| >> | No. 8666

8666

>>8665 |

| >> | No. 8667

8667

>>8666 |

| >> | No. 8668

8668

>>8667 |

| >> | No. 8677

8677

1588170687766.jpg

>>8666 |

| >> | No. 8679

8679

>>8667 |

| >> | No. 8681

8681

>>8679 |

| >> | No. 8682

8682

>>8677 |

| >> | No. 8683

8683

>>8679 |

| >> | No. 8684

8684

Exsctly. Putting £150 a month into a fund that makes on average 15% a year for 30 years and you're at a million no bother. |

| >> | No. 8686

8686

>>8679 |

| >> | No. 8687

8687

>>8686 |

| >> | No. 8688

8688

>>8687 |

| >> | No. 8689

8689

>>8687 |

| >> | No. 8690

8690

Untitled.png   >>8689 |

| >> | No. 8691

8691

>>8690 |

| >> | No. 8692

8692

>>8691 |

| >> | No. 8694

8694

>>8691 |

| >> | No. 8695

8695

>>8694 |

| >> | No. 8696

8696

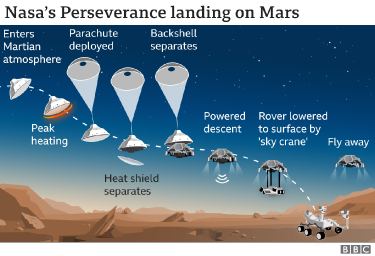

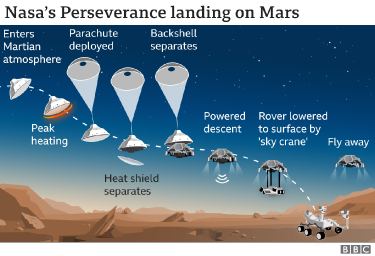

_117003116_perserverance_landing_x2_640-nc.png

>>8695 |

| >> | No. 8697

8697

parachute-with-figure-soldier-toy-for-kids.jpg

>>8696 |

| >> | No. 8698

8698

>>8689 |

| >> | No. 8699

8699

>>8698 |

| >> | No. 8700

8700

OP here. I just spent a good bit of my morning searching for this using key phrases like "social mobility without inheritance", "social mobility of the nouveau riche", "sociological studies of wealth accumulation", "wealth accumulation among poor households", etc. in academic and non-academic search engines. |

| >> | No. 8701

8701

>>8700 |

| >> | No. 8702

8702

>>8631 |

| >> | No. 8703

8703

>>8702 |

| >> | No. 8704

8704

>>8703 |

| >> | No. 8705

8705

molesworth.jpg

>>8704 |

| >> | No. 8706

8706

Have you answered to yourself where being rich turns into wealth? Because the latter has some connotations that matter. |

| >> | No. 8709

8709

>>8706 |

| >> | No. 8852

8852

6253666696_473a07a266_b_OR3xqZH.width-800.jpg

I was looking into this topic again today and recalled a powerfully honest article written by someone that earned what they call a "private basic income", i.e. they'll never have to work again. He seems to want to communicate the absurdity of his situation: |

| >> | No. 8853

8853

>>8852 |

| >> | No. 8854

8854

>>8853 |

| >> | No. 8855

8855

>>8852 |

| >> | No. 8856

8856

>>8854 |

| >> | No. 8857

8857

image_2021-06-14_100707.png

>>8855 |

| >> | No. 8860

8860

>>8855 |

| >> | No. 8861

8861

download (10).jpg

>>8860 |

| >> | No. 8862

8862

>>8861 |

| >> | No. 8863

8863

There's certainly a large amount of luck involved, because whatever guide you wind up with, there will be thousands of people who did everything on it and aren't millionaires. One thing that I think hasn't been mentioned yet is passion: people say you need to work hard, but you need to enjoy it too. Stephen Hendry spent his whole life on a snooker table and was world champion seven times. Sergio Aguero stayed late at football training every day until he was better at football than Bojan Krkic is, or you are. But what if they had swapped places? Would Sergio Aguero be a snooker champion and Stephen Hendry lifting the World Cup for Scotland? I doubt it enormously. They had the drive to succeed at what they wanted, but they also had the passion to enjoy it in the first place. I'm willing to guess that most of us, in our jobs, have bosses who love what we do more than we do. They'd do it at home for free if they could, and that's why they're good enough at it to get paid more than we do. But their drive to do our jobs does not translate into drive to be the world's best Cubist painter or Love Island contestant. In the end, it's just a question of personality. |

| >> | No. 8864

8864

>>8863 |

| >> | No. 8865

8865

>>8863 |

| >> | No. 8866

8866

I distinctly remember watching some video of some quality control people on an assembly line in the 70s or 80s testing electronics and thinking that if they had the radio on it would be my ideal job: boring, predictable, rote actions (plug it in, if it loads then box it, if it doesn't then chuck it) that you could do while daydreaming away to yourself. Unfortunately jobs like that no longer seem to exist (insofar as they ever did), so you're stuck with stuff that demands a much higher level of engagement and awareness, making it much more difficult to just compartmentalise away work and then come home to live your life. |

| >> | No. 8867

8867

>>8866 |

| >> | No. 8868

8868

>>8865 |

| >> | No. 8869

8869

>>8866 |

| >> | No. 9540

9540

I'm still on the lookout for research on this subject and chanced (heh) upon this article from a bunch of MIT maths wonks: https://arxiv.org/abs/1802.07068 |

| >> | No. 10119

10119

https://www.fca.org.uk/news/press-releases/more-people-have-bank-accounts-one-ten-have-no-cash-savings |

| >> | No. 10120

10120

>>10119 |

[ Return ] [ Entire Thread ] [ Last 50 posts ]

|

Delete Post [] Password |