[ Return ] [ Entire Thread ] [ First 100 posts ] [ Last 50 posts ]

| >> | No. 8729

8729

Previously on Britfags: The Origin |

| >> | No. 8730

8730

>>8729 |

| >> | No. 8731

8731

Now is a terrible time to buy a house. Estate agents are literally worrying that they might completely sell out of houses, the market is booming so obscenely. I have £35,000 sitting around, and with my annual income of around £28,000, that means I can just about buy a house for £160,000, which was the going rate round here until about six months ago. Now every house is £180,000, so I might as well have just blown it all on crack and lottery tickets for all the help I'm going to get. |

| >> | No. 8732

8732

Possible solutions: |

| >> | No. 8735

8735

>>8732 |

| >> | No. 8736

8736

DO NOT BUY SHARED OWNERSHIP - You would have to be a moron to do so. |

| >> | No. 8737

8737

>>8735 |

| >> | No. 8738

8738

Not sure how it's going up north, but down here in the south west somehow ALL the houses are going, I don't know where these people are getting the money as some around here have gone for 25-50k over the asking price because there's been such fierce competition. By the time a house has gone online first thing in the morning it's already got a few offers by the afternoon, some people aren't even physically viewing these properties. Seems to be a lot of people coming down from London but even then, it's absurd right now. |

| >> | No. 8739

8739

>>8738 |

| >> | No. 8740

8740

>>8738 |

| >> | No. 8741

8741

>>8738 |

| >> | No. 8742

8742

>>8738 |

| >> | No. 8743

8743

>>8738 |

| >> | No. 8744

8744

>>8742 |

| >> | No. 8746

8746

>>8744 |

| >> | No. 8747

8747

The government have just launched a mortgage guarantee scheme to increase the availability of 95% mortgages: |

| >> | No. 8748

8748

>>8746 |

| >> | No. 8749

8749

>>8747 |

| >> | No. 8750

8750

>>8747 |

| >> | No. 8751

8751

>>8749 |

| >> | No. 8752

8752

>>8747 |

| >> | No. 8859

8859

>>8777 |

| >> | No. 8872

8872

>It is cheaper to rent a property than it is to buy a home for the first time in more than six years, says Hamptons. |

| >> | No. 8877

8877

>>8872 |

| >> | No. 8879

8879

>>8877 |

| >> | No. 8880

8880

>>8879 |

| >> | No. 8881

8881

>>8880 |

| >> | No. 8882

8882

>>8881 |

| >> | No. 8883

8883

>>8882 |

| >> | No. 8884

8884

>>8883 |

| >> | No. 8885

8885

>>8882 |

| >> | No. 8901

8901

|

| >> | No. 8902

8902

>>8901 |

| >> | No. 8903

8903

>>8885 |

| >> | No. 8904

8904

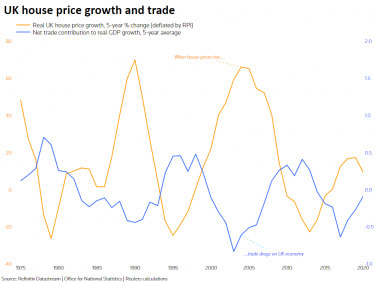

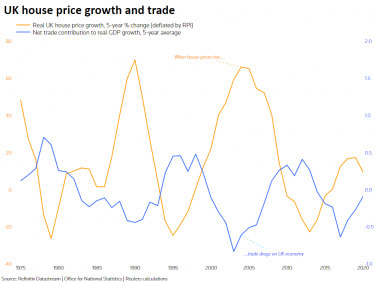

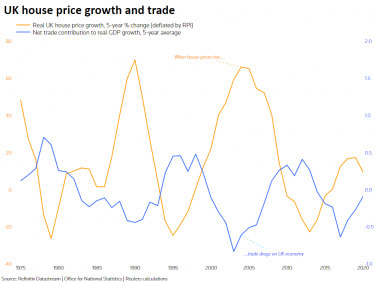

Pasted image 1625476741307.png

>UK housing boom may derail post-Brexit trade dreams |

| >> | No. 8905

8905

>>8904 |

| >> | No. 8906

8906

>>8905 |

| >> | No. 8907

8907

job.jpg

>>8903 |

| >> | No. 8908

8908

>>8905 |

| >> | No. 8916

8916

>>8905 |

| >> | No. 8936

8936

I need some help from the Britfags mandem. |

| >> | No. 8937

8937

>>8936 |

| >> | No. 8938

8938

>>8936 |

| >> | No. 8939

8939

>>8937 |

| >> | No. 8940

8940

>>8938 |

| >> | No. 8941

8941

I've just applied for a mortgage in principle aaaaaaaagghhhhhh |

| >> | No. 8942

8942

>>8941 |

| >> | No. 9216

9216

I have had an offer accepted! Homeownership, here I come! Now I need to arrange some solicitors. Looking online, pro tip #1 is to ask people to recommend someone. Pro tip #2 is to speak to three different ones and ask for quotes. But I know there must be homeowners here. Does anyone have any special advice about solicitors? The estate agent says they can help, but they could be just recommending their shady friends like they do with mortgage advisors. |

| >> | No. 9218

9218

>>9216 |

| >> | No. 9219

9219

>>9216 |

| >> | No. 9220

9220

>>9219 |

| >> | No. 9236

9236

Just had a chat with the bank about an agreement in principle and apparently their systems are only giving them an affordability of about £80,000 with a 15% deposit, but even the person I was talking to seemed confused and said that it should be quite a bit higher given my income. |

| >> | No. 9237

9237

>>9236 |

| >> | No. 9238

9238

>>9237 |

| >> | No. 9239

9239

>>9237 |

| >> | No. 9240

9240

>>9239 |

| >> | No. 9246

9246

>>9240 |

| >> | No. 9247

9247

>>9246 |

| >> | No. 9248

9248

>>9246 |

| >> | No. 9249

9249

>>9248 |

| >> | No. 9252

9252

Today's house search annoyance is how many listings I've come across with this "Comitted Buyer Process" shite, where they try and make it sound like they're doing you a favour ("Committed Buyer is a new, innovative and pioneering process for buying and selling property" my fucking arse, jesus motherfucking christ), when they're really just asking for an extra three grand just to reserve the place, on top of the deposit and solicitor's fees and surveyors and shit you're already paying for. |

| >> | No. 9253

9253

>>9252 |

| >> | No. 9254

9254

>>9253 |

| >> | No. 9255

9255

>>9252 |

| >> | No. 9256

9256

>>9253 |

| >> | No. 9560

9560

I went to the bank today to pay for my house. All my money in the world, £44,000 of it, got transferred. I have a couple of gripes. Firstly, my lawyers initially said there would be a £30 charge to let them transfer my money to the sellers. Fair enough, if it means I don't have to do it. Then, last week, they sent me The Big Bill with all their charges plus the deposit for the house, and they've bloody put the £30 on there again. That, or the prices have gone up to £60. So I was faintly peeved about that. But on top of this, I still need to transfer the money to the lawyers myself; I'm only paying them to pass it on to the sellers after they've hung onto it for a couple of days. So I had to go to the bank anyway. Worst of all, at the bank, because I was sending it to Barclays or something like that, I had to pay a £23 charge to pay the lawyers £44,060 which includes the two charges I had already paid for this exact service. |

| >> | No. 9561

9561

>>9255 |

| >> | No. 9562

9562

>>9252 |

| >> | No. 9663

9663

|

| >> | No. 9664

9664

>>9663 |

| >> | No. 9665

9665

Ahh. Funny to read back through this thread when it contains all the posts from the beginning of my First Time Buyer Home Buying Journey. |

| >> | No. 9666

9666

>>9665 |

| >> | No. 9667

9667

>>9665 |

| >> | No. 9668

9668

>>9667 |

| >> | No. 9669

9669

>>9668 |

| >> | No. 9670

9670

The UK 10 year gilt yield is now back above 4%. Unlike last October, it is likely to remain there, too. Mortgage rates will follow and we will finally have a 90s-esq house price crash. |

| >> | No. 9671

9671

>>9670 |

| >> | No. 9672

9672

>>9671 |

| >> | No. 9673

9673

>>9672 |

| >> | No. 9674

9674

>>9673 |

| >> | No. 9675

9675

>>9673 |

| >> | No. 9676

9676

>>9675 |

| >> | No. 9677

9677

>>9675 |

| >> | No. 9678

9678

>>9676 |

| >> | No. 9679

9679

>>9678 |

| >> | No. 9680

9680

>>9675 |

| >> | No. 9681

9681

>>9680 |

| >> | No. 9682

9682

>>9681 |

| >> | No. 9703

9703

You lot aren't angry enough lately for my liking. |

| >> | No. 9704

9704

>>9703 |

| >> | No. 9705

9705

>>9703 |

| >> | No. 9706

9706

>>9703 |

| >> | No. 9707

9707

>>9706 |

| >> | No. 9708

9708

>>9707 |

| >> | No. 9709

9709

>>9708 |

| >> | No. 9710

9710

>>9709 |

| >> | No. 9711

9711

>>9709 |

| >> | No. 9712

9712

Right I bartered a property right down and the seller reluctantly accepted. |

| >> | No. 9713

9713

>>9712 |

| >> | No. 9798

9798

1500.jpg

>A Tory MP said he quit his ministerial role because he could not afford to pay his mortgage on a salary of £118,300. |

| >> | No. 9799

9799

>>9798 |

| >> | No. 9800

9800

>>9798 |

| >> | No. 9801

9801

>>9800 |

| >> | No. 9802

9802

>>9801 |

[ Return ] [ Entire Thread ] [ First 100 posts ] [ Last 50 posts ]

|

Delete Post [] Password |