[ Return ]

| >> | No. 9683

9683

I have a predicament: I'm putting aside some money for a wedding and stag-do coming up along with finally getting around to learning how to drive. I've done the figures and gotten to £1360 and £1034 respectively which I'll build up over 12~ months by diverting 10% from my savings and adding in random drabs from elsewhere. |

| >> | No. 9684

9684

2b2py5p8ry4b1.jpg

You can get at least 4% on an instant access account these days, even more with a fixed or regular saver. |

| >> | No. 9685

9685

>>9684 |

| >> | No. 9686

9686

>>9683 |

| >> | No. 9687

9687

>>9684 |

| >> | No. 9688

9688

>>9684 |

| >> | No. 9689

9689

>>9688 |

| >> | No. 9690

9690

>>9689 |

| >> | No. 9691

9691

>>9690 |

| >> | No. 9692

9692

>>9691 |

| >> | No. 9693

9693

>>9692 |

| >> | No. 9694

9694

>>9693 |

| >> | No. 9695

9695

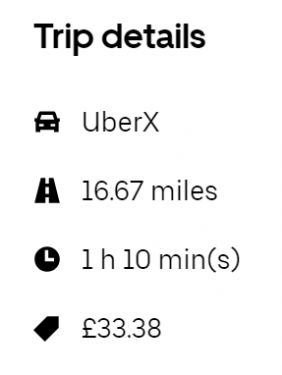

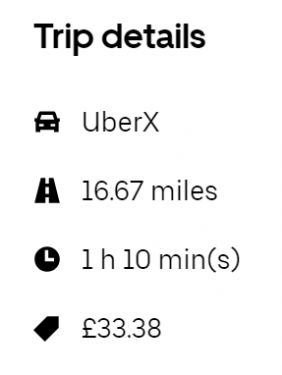

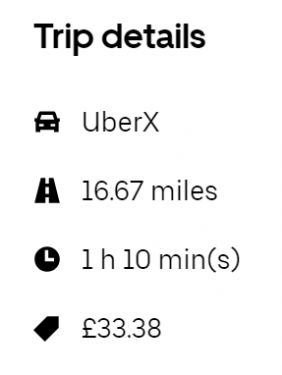

taxi.png

>>9694 |

| >> | No. 9696

9696

>>9693 |

| >> | No. 9697

9697

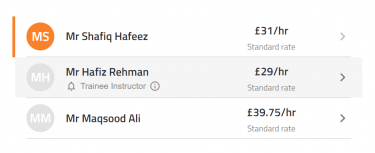

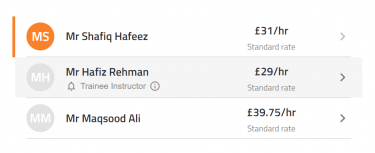

instr.png   >>9696 |

| >> | No. 9698

9698

>>9697 |

| >> | No. 9699

9699

>>9695 |

[ Return ]

|

Delete Post [] Password |