[ Return ] [ Entire Thread ] [ First 100 posts ] [ Last 50 posts ]

| >> | No. 3840

3840

The OFT have come out and said that many old (i.e. set up before 2001) pension schemes have high charges and offer savers poor value for money. They've also suggested a cap for auto-enrolment schemes, but it's going to be an almost meaningless gesture as you'd be very hard pressed to find a provider offering auto-enrolment terms with annual management charges greater than 1% anyway. |

| >> | No. 3841

3841

Spy.jpg   Did someone say pension....? |

| >> | No. 3842

3842

UK pensions are a waste of time. It's amazing how it varies abroad though. Value for money is far better elsewhere, sadly (for most the UK population being screwed daily). |

| >> | No. 3843

3843

>>3842 |

| >> | No. 3858

3858

To me, Auto Enrolment seems like an excuse to scale back the State Pension because more people will have their own personal pensions. |

| >> | No. 3859

3859

>>3858 |

| >> | No. 3860

3860

>>3859 |

| >> | No. 3861

3861

>>3860 |

| >> | No. 3862

3862

Annuityrates.png   >>3861 |

| >> | No. 3863

3863

>>3861 |

| >> | No. 3864

3864

>>3863 |

| >> | No. 3865

3865

>>3858 |

| >> | No. 3866

3866

>>3865 |

| >> | No. 3867

3867

>>3866 |

| >> | No. 3868

3868

>>3867 |

| >> | No. 3869

3869

>>3868 |

| >> | No. 3870

3870

>>3868 |

| >> | No. 3871

3871

>>3869 |

| >> | No. 3872

3872

>>3871 |

| >> | No. 3873

3873

>>3872 |

| >> | No. 3874

3874

>>3873 |

| >> | No. 3875

3875

|

| >> | No. 3876

3876

I could be wrong, but aren't group money purchase schemes quite dated now? As far as I'm aware, they're occupational schemes that employers used in the 80's and 90's when they were switching from defined benefit (final/average salary) schemes to defined contribution schemes which still kept the trustee structure in place. These days new pension schemes are almost certain to be group personal pension plans. I don't know if this meant the trustees could choose what the scheme assets should be invested in or if that only applies to defined benefit schemes. |

| >> | No. 3877

3877

>>3876 |

| >> | No. 3878

3878

>>3877 |

| >> | No. 3879

3879

>>3877 |

| >> | No. 3880

3880

>>3875 |

| >> | No. 3881

3881

>>3868 |

| >> | No. 3883

3883

Apparently they're mad on Mumsnet that Auto-Enrolment means they'll have to pay pension contributions for nannies, gardeners and cleaners. |

| >> | No. 3885

3885

>>3884 |

| >> | No. 3886

3886

>>3883 |

| >> | No. 3887

3887

>>3885 |

| >> | No. 3892

3892

Cofunds have announced they're scrapping their £40 annual platform charge (although the reality is that they forgot to actually charge anyone for it since they implemented it in January). |

| >> | No. 3893

3893

They've just had a pensions expert on BBC Breakfast, because Scottish Widows have released a report saying that a 25-year-old needs to save £66 per month if they want an annual income of £5,800 (with no inflation proofing) on top of the State Pension when they retire. |

| >> | No. 3894

3894

>>3893 |

| >> | No. 3895

3895

>>3894 |

| >> | No. 3896

3896

>>3895 |

| >> | No. 3897

3897

>>3896 |

| >> | No. 3898

3898

Can someone explain because I'm not quite sure. What's the difference between giving my money to a pension provider and keeping money stuffed underneath my mattress? |

| >> | No. 3899

3899

>>3898 |

| >> | No. 3900

3900

>>3899 |

| >> | No. 3901

3901

>Management fees charged by pension providers could be capped between 0.75% and 1%, according to proposals being set out by the government. The Treasury is consulting on its plans to cap fees, which it says could save people tens of thousands of pounds. Some older schemes set up more than a decade ago have been found to charge up to 2.3% a year in management fees. |

| >> | No. 3902

3902

>>3901 |

| >> | No. 3935

3935

I was at a presentation by Standard Life and Aviva earlier. |

| >> | No. 3936

3936

>>3935 |

| >> | No. 3937

3937

>>3936 |

| >> | No. 3945

3945

>>3936 |

| >> | No. 3946

3946

>>3945 |

| >> | No. 3947

3947

They've been talking about salary sacrifice at work. They gave me a statement that shows that if they reduce my gross pay by nearly 6% my net pay will remain the same because there's less income tax and national insurance to pay along with no personal pension deduction. They then pay an employer contribution that is just under 13% greater than what's paid overall now. Any reason I shouldn't do it? |

| >> | No. 3948

3948

>>3947 |

| >> | No. 4036

4036

>>3948 |

| >> | No. 4037

4037

Last thing I'll say on the pension charges cap, the FT say it is a bad idea but can see why Webb has gone for it as it "offers the chance for jolly soundbites. It is not, however, based on good economics." The OFT also recommend against a cap. |

| >> | No. 4049

4049

The problem with salary sacrifice and lowering your gross pay is the impact on the "ladder". Typically once you get a rung up you should have a floor under you that increases each step of the way. By accepting this drop you're knocking yourself down if you move to another employer or role. |

| >> | No. 4050

4050

>>4049 |

| >> | No. 4052

4052

>>4049 |

| >> | No. 4095

4095

Apparently Mexico is the only developed nation with a State Pension less generous than ours. |

| >> | No. 4096

4096

>>4050 |

| >> | No. 4097

4097

>>4095 |

| >> | No. 4098

4098

>>4096 |

| >> | No. 4099

4099

>>4098 |

| >> | No. 4100

4100

>>4096 |

| >> | No. 4101

4101

>>4098 |

| >> | No. 4105

4105

>>4100 |

| >> | No. 4108

4108

>>4105 |

| >> | No. 4228

4228

>>4097 |

| >> | No. 4262

4262

On the subject of National Insurance: |

| >> | No. 4263

4263

>>4262 |

| >> | No. 4264

4264

>>4262 |

| >> | No. 4265

4265

>>4264 |

| >> | No. 4266

4266

>>4265 |

| >> | No. 4268

4268

>>4262 |

| >> | No. 4271

4271

>>4268 |

| >> | No. 4273

4273

>>4271 |

| >> | No. 4275

4275

>The date when people must be 68 to draw a state pension - formerly scheduled for 2046 - will be brought forward to the mid-2030s, Chancellor George Osborne will announce later. Plans to be announced in Mr Osborne's Autumn Statement mean the age could rise again to 69 by the late 2040s. |

| >> | No. 4276

4276

>>4275 |

| >> | No. 4277

4277

>>4275 |

| >> | No. 4278

4278

>>4276 |

| >> | No. 4279

4279

>>4277 |

| >> | No. 4280

4280

>>4278 |

| >> | No. 4281

4281

>>4280 |

| >> | No. 4282

4282

>>4280 |

| >> | No. 4283

4283

>>4276 |

| >> | No. 4288

4288

>>4283 |

| >> | No. 4290

4290

>>4288 |

| >> | No. 4331

4331

Pensioners are being 'burgled' by insurers on annuities |

| >> | No. 4358

4358

The Graun are saying people in their 20s should be putting 12% of their salary away for retirement and even more if they leave pension saving until later. |

| >> | No. 4359

4359

>>4358 |

| >> | No. 4360

4360

>>4359 |

| >> | No. 4733

4733

I've heard that if you get enrolled in a pension scheme the government have made it a bit of a hassle to opt out in the hope that people won't be bothered - something about going to the far end of a fart to request the necessary forms because your employer isn't allowed to give you one so they can't pressure you into opting out. Even if you do opt out your employer will already have made a deduction from your pay and you'll have to wait until the next payroll to get it refunded. At least, these are the gripes I've heard from colleagues. |

| >> | No. 4734

4734

>>4360 |

| >> | No. 4736

4736

>>4734 |

| >> | No. 4738

4738

>>4736 |

| >> | No. 4746

4746

>>4738 |

| >> | No. 4756

4756

So when are interest rates going to finally go up high enough (or at all) to make saving and pensions worth while? Right now and for some time it has felt punishing to those who spent their lives doing the right thing while the BoE and government push everyone to breaking point and bend over backwards for those who were reckless and lived beyond their means. |

| >> | No. 4758

4758

>>4756 |

| >> | No. 4760

4760

>>4756 |

| >> | No. 4761

4761

>>4756 |

| >> | No. 4762

4762

>>4761 |

| >> | No. 4764

4764

>>4761 |

| >> | No. 4765

4765

>>4760 |

| >> | No. 4766

4766

>>4764 |

| >> | No. 4767

4767

>>4765 |

| >> | No. 4769

4769

>>4767 |

| >> | No. 4770

4770

>>4769 |

| >> | No. 4775

4775

Polly has written a fluff piece about Steve Webb's decision to postpone putting a cap on Auto Enrolment charges for at least a year. It may be just me, but it seems like a meandering mess that glosses over the subject matter so she can have a pop at the wicked corporations (even though if you read the pension industry's response to the DWP consultation they are overwhelmingly in favour of standardising charges and making disclosure of them mandatory) and the nasty Tories (Steve Webb is a twat trying to grab headlines). I'm not convinced she actually knows the difference between a pension fund and a pension provider. In fact, it's worse than that - scaremongering and discouraging young people from retirement planning, when the average charge on a pension scheme set up in 2012 was a reasonable 0.51% (almost all of the money in schemes with high charges were set up over a decade ago) and there has been several reports recently warning that many are likely to face poverty in old age because they have barely put any thought to funding their retirement, is incredibly reckless. Polly is trying to perpetuate the narrative that pensions are confusing and a rip-off without really trying to understand the subject matter because it goes against what she wants to preach. She's misrepresenting Mitchell Johnson at the end; he's recommended having one combined annual allowance for pensions (which will be £40k for 2014/15) and ISAs (£11,880) which you can split how you like, but Polly has somehow construed that as meaning they're going to get rolled into one account. The only way I can fathom the line 'The Treasury would add £1 for every £1 saved, equal relief for all' from what I can see in the report (http://www.cps.org.uk/files/reports/original/121123104830-costlyandineffective.pdf) is that she has completely misunderstood the recommendation about scrapping higher rate tax relief on pension contributions so that everyone gets the same % rate - I can find no mention of this outside of her article. |

| >> | No. 4776

4776

>>4775 |

| >> | No. 4777

4777

>>4776 |

| >> | No. 4810

4810

>>4756 |

| >> | No. 4816

4816

>>4810 |

| >> | No. 4854

4854

One of yesterday's Editor's Picks on the Graun was another opinion piece of pensions - this time by some bint at Investors Chronicle. |

| >> | No. 4855

4855

>>4854 |

| >> | No. 4856

4856

>>4855 |

| >> | No. 4857

4857

>>4856 |

| >> | No. 4858

4858

>>4857 |

| >> | No. 4859

4859

>>4858 |

| >> | No. 4860

4860

>>4859 |

| >> | No. 4861

4861

the-slammer.jpg   >>4860 |

| >> | No. 4894

4894

The government are considering privatising the administration of the State Pension or, judging by the last line, the Guardian could be engaging in some Daily Mail style scaremongering. |

| >> | No. 4895

4895

>>4894 |

| >> | No. 4896

4896

>>4895 |

| >> | No. 4897

4897

>>4896 |

| >> | No. 4898

4898

>>4897 |

| >> | No. 4899

4899

>>4898 |

| >> | No. 4903

4903

>>4899 |

| >> | No. 4904

4904

>>4903 |

| >> | No. 4937

4937

>>4761 |

| >> | No. 4950

4950

90% of people know that they can a better annuity at retirement if they shop around, but only around half can be bothered to do so - I'd say this is more a case of people not giving too much attention to one of the most important financial decisions they have to make than the system being 'broken', although it certainly has its flaws. It's well known in many industries that lazy customers who stick with one provider/insurer won't get the best deal, some people won't be happy until they don't have to take any personal responsibility for their own lives whatsoever and get their arses wiped for them instead. |

| >> | No. 4951

4951

Thinking about it, the solution is bleeding obvious. If the government makes it compulsory for annuity providers to publish a table of their standard rates each week, say what £100k could buy someone on their 55th to 65th birthday, and gets The Pensions Advisory Service to compile them in one place then there's no excuse not to shop around and it could see rates rising. It really is that simple, no need for bluster and the FCA to investigate for a further year. |

| >> | No. 5071

5071

In the budget they've said that they're increasing the limits for trivial commutation (cashing it in because the values are too low) from £2,000 to £10,000 from one employment and from £18,000 to £30,000 for your overall pension benefits. |

| >> | No. 5086

5086

>>5071 |

| >> | No. 5087

5087

>>5086 |

| >> | No. 5088

5088

>Osborne unveiled a series of reforms that come into force on 27 March, abolishing several technical rules that will mean pensioners can take more of their savings as cash immediately. He also promised by April next year to remove all remaining tax restrictions on access to pension pots. "Pensioners will have complete freedom to draw down as much or as little of their pension pot as they want, any time they want. No caps. No drawdown limits." |

| >> | No. 5089

5089

>>5088 |

| >> | No. 5090

5090

_73690936_bingoad[1].jpg   I thought this poster was a joke at first. Then I found out it's legit. |

| >> | No. 5091

5091

>>5090 |

| >> | No. 5095

5095

>>5091 |

| >> | No. 5096

5096

>>5089 |

| >> | No. 5098

5098

>>5090 |

| >> | No. 5099

5099

>>5090 |

| >> | No. 5100

5100

almurraypointingIm005223_lightbox.jpg

>>5091 |

| >> | No. 5102

5102

>>5099 |

| >> | No. 5104

5104

>>5102 |

| >> | No. 5105

5105

>>5104 |

| >> | No. 5106

5106

>>5105 |

| >> | No. 5107

5107

>>5106 |

| >> | No. 5108

5108

HOORAY FOR GIDEON |

| >> | No. 5109

5109

We could still have a very cold winter yet, Gids. It's not over. |

| >> | No. 5110

5110

Jesus! I don't think I've ever seen quite so much Old Etonian jizzum roll down the chin of a newspaper before. Not to say it's never happened of course. |

| >> | No. 5111

5111

>>5110 |

| >> | No. 5112

5112

Balls' response is that people will squander their money if they can take it all at once; Labour really hate letting people take personal responsibility for their own lives. |

| >> | No. 5117

5117

>>5112 |

| >> | No. 5121

5121

>>5117 |

| >> | No. 5122

5122

>>5111 |

| >> | No. 5125

5125

>>5121 |

| >> | No. 5129

5129

>>5125 |

| >> | No. 5138

5138

>>5122 |

| >> | No. 5139

5139

>>5110 |

| >> | No. 5140

5140

>>5088 |

| >> | No. 5142

5142

Savers locked into rip-off pensions and investments could be given a free exit or moved to better deals, regulators will say next week. |

| >> | No. 5143

5143

>>5142 |

| >> | No. 5144

5144

>>5143 |

| >> | No. 5145

5145

>>5144 |

| >> | No. 5146

5146

>>5144 |

| >> | No. 5147

5147

>>5146 |

| >> | No. 5156

5156

This seems to have gone under the radar after the budget, but the government announced towards the end of last week that, with effect from 1 April 2015, the default fund for qualifying workplace pension schemes will be capped at 0.75% and they'll review it in 2017. |

| >> | No. 5180

5180

Steve Webb has said that the next government will have to look into increasing the minimum contributions for Auto Enrolment from 8% as it won't be enough for many. |

| >> | No. 5200

5200

Apparently we have one of the most sustainable pension systems in the world. God help everywhere else. |

| >> | No. 5204

5204

>Employees will be able to put their money into Dutch-style “collective pensions”, shared with thousands of other members, in a radical shake-up of workplace pensions expected to be disclosed in the Queen's speech on Wednesday. |

| >> | No. 5205

5205

>>5204 |

| >> | No. 5206

5206

>>5205 |

| >> | No. 5207

5207

>>5205 |

| >> | No. 5208

5208

>>5207 |

| >> | No. 5209

5209

Apparently tax relief on pensions is going to be one of the electioneering 'battlegrounds'. The Centre for Policy Studies say it should be 50%, but only on the first £8k, the Lib Dems want it capped at somewhere between 20-30%, the Tories haven't come up with a plan yet and Labour want to keep it at 40% for higher rate taxpayers but cap it at 20% for additional rate taxpayers. |

| >> | No. 5214

5214

The finalised details of the pension reforms unveiled in the budget will be unveiled tomorrow, following the consultation period: |

| >> | No. 5215

5215

>>5214 |

| >> | No. 5216

5216

>>5214 |

| >> | No. 5272

5272

>>5125 |

| >> | No. 5276

5276

>>5125>>5272 |

| >> | No. 5341

5341

>>4746 |

| >> | No. 5371

5371

It's in the news today that you can stagger taking your tax-free cash (which you could anyway) and Osborne is proclaiming that YOU CAN USE YOUR PENSION JUST LIKE A BANK ACCOUNT. |

| >> | No. 5373

5373

The Pensions Advisory Service has launched a pilot where they offered free guidance to 9,000 retirees, only 2.5% took them up. So much for Gideon's posturing. |

| >> | No. 5413

5413

OP here, if I take this complaint to the Financial Ombudsman Service do you think I have a case? Apologies in advance if it's tl;dr. |

| >> | No. 5490

5490

Labour want to cut tuition fees to £6,000 and they're going to fund this by capping the amount you can take tax-free from your pensions at £36,000 and changing tax relief on contributions for basic and higher rate taxpayers to a flat 30% while lowering it to 20% for additional rate taxpayers. |

| >> | No. 5491

5491

>>5490 |

| >> | No. 5492

5492

>>5491 |

| >> | No. 5493

5493

>>5491 |

| >> | No. 5494

5494

>>5492 |

| >> | No. 5495

5495

>>5494 |

| >> | No. 5496

5496

Isn't it only high earners who actually pay off their tuition fee loan? I have no idea how much you have to earn for your repayments to be greater than the added interest but I don't seem to have made much headway in paying off my loan. |

| >> | No. 5497

5497

>>5496 |

| >> | No. 5498

5498

>>5497 |

| >> | No. 5499

5499

>>5498 |

| >> | No. 5500

5500

>>5499 |

| >> | No. 5501

5501

>>5495 |

| >> | No. 5502

5502

Well if we Greens had our way we'd scrap all the fees. Under the current system, although poor people aren't necessarily burdened with the loan, the taxpayer will always lose out in the long-term (it's like a PFI for higher education); rich people who pay their fees out of their own pocket get to avoid the inflation-tied interest and hence opt out of the graduate-tax-like system anyway, which is regressive; and as the Tories keep selling off the loan books there's no telling what conditions the former students will have imposed on them in the future. Best way to fund it, like pretty much all public services, is make it free at the point of use for all and raise progressive taxes on the rich. |

| >> | No. 5503

5503

>>5502 |

| >> | No. 5504

5504

>>5503 |

| >> | No. 5505

5505

University should be more expensive and difficult to get into, and the repayments more harsh. Yesterday at University, two students were bragging about getting low 50s in their essays because they'd done it all in the last day and barely read anything. A lot of the people in that class are the same. They just don't care, and I think it's because they're not really paying for it. Taxpayers are paying for it. People measure how they should treat things by how much they paid for it. Those students would be more upset about dropping their phone than failing their essays. |

| >> | No. 5506

5506

>>5505 |

| >> | No. 5507

5507

>>5505 |

| >> | No. 5508

5508

>>5505 |

| >> | No. 5509

5509

http://britfa.gs/pol/ |

| >> | No. 5510

5510

>>5502 |

| >> | No. 5511

5511

>>5510 |

| >> | No. 5512

5512

>>5510 |

| >> | No. 5513

5513

Are we trying to become like America? Why can't we have free, or maybe just really cheap tuition fees? |

| >> | No. 5514

5514

http://britfa.gs/pol/ |

| >> | No. 5515

5515

>>5514 |

| >> | No. 5516

5516

>>5508 |

| >> | No. 5517

5517

http://britfa.gs/pol/ |

| >> | No. 5518

5518

>>5513 |

| >> | No. 5519

5519

>>5518 |

| >> | No. 5520

5520

>>5519 |

| >> | No. 5521

5521

So, what about them pensions, eh then, lads? |

| >> | No. 5522

5522

>>5521 |

| >> | No. 5523

5523

>>5520 |

| >> | No. 5524

5524

0.jpg   WHAT? |

| >> | No. 5525

5525

>>5523 |

| >> | No. 5526

5526

>>5525 |

| >> | No. 5527

5527

>>5522 |

| >> | No. 5528

5528

>>5527 |

| >> | No. 5529

5529

>>5528 |

| >> | No. 5530

5530

>>5518 |

| >> | No. 5531

5531

>>5527 |

| >> | No. 5532

5532

Harry.jpg   >>5531 |

| >> | No. 5533

5533

wotevs.jpg   >>5532 |

| >> | No. 5534

5534

>>5518 |

| >> | No. 5535

5535

>>5534 |

| >> | No. 5536

5536

>>5534 |

| >> | No. 5537

5537

>>5536 |

| >> | No. 5538

5538

>>5537 |

| >> | No. 5539

5539

>>5535 |

| >> | No. 5540

5540

>>5538 |

| >> | No. 5542

5542

>>5534 |

| >> | No. 5543

5543

>>5540 |

| >> | No. 5544

5544

>>5542 |

| >> | No. 5545

5545

>>5544 |

| >> | No. 5546

5546

>>5542 |

| >> | No. 5547

5547

>>5544 |

| >> | No. 5548

5548

>>5546 |

| >> | No. 5549

5549

>>5547 |

| >> | No. 5550

5550

>>5549 |

| >> | No. 5551

5551

>>5550 |

| >> | No. 5552

5552

>>5549 |

| >> | No. 5553

5553

>>5549 |

| >> | No. 5554

5554

>>5550 |

| >> | No. 5555

5555

>>5554 |

| >> | No. 5556

5556

>>5555 |

| >> | No. 5557

5557

>>5551 |

| >> | No. 5559

5559

>>5557 |

| >> | No. 5560

5560

>>5556 |

| >> | No. 5561

5561

>>5544 |

| >> | No. 5562

5562

>>5561 |

| >> | No. 5563

5563

>>5562 |

| >> | No. 5564

5564

>>5563 |

| >> | No. 5565

5565

>>5562 |

| >> | No. 5566

5566

>>5565 |

| >> | No. 5567

5567

When you are born, you take on a "debt" that is never paid off, that is structured in the same way as student debt, but you get no say in it. It's called income tax. |

| >> | No. 5568

5568

>>5567 |

| >> | No. 5569

5569

>>5568 |

| >> | No. 5570

5570

>>5568 |

| >> | No. 5572

5572

>>5568 |

| >> | No. 5573

5573

>>5569 |

| >> | No. 5575

5575

>>5573 |

| >> | No. 5576

5576

Getting back to pensions for a moment (controversial idea, I know): |

| >> | No. 5577

5577

>>5576 |

| >> | No. 5578

5578

>>5576 |

| >> | No. 5579

5579

>>5578 |

| >> | No. 5580

5580

>>5576 |

| >> | No. 5581

5581

>>5577 |

| >> | No. 5582

5582

>>5580 |

| >> | No. 5583

5583

>>5582 |

| >> | No. 5584

5584

Miliband's claiming he'd cap charges on drawdown plans, citing some charging as much as 2.75%. You'd have to be pretty thick to pay that much - Royal London's offering is 0.50% for plans greater than £60k, Scottish Widows' 0.28% for plans greater than 50%, LV's is 0.25% on plans above £20k, Aegon's is 0.3% on the first £250k, Aviva's is 0.30% for plans above £30k and Legal & General's is 0.1% above £30k, so it looks like a meaningless soundbite to me as I can't imagine anyone going into drawdown as a result of the Budget changes paying excessive charges unless they're an utter mong. |

| >> | No. 5585

5585

Hang on, lads, I've just had a thought. |

| >> | No. 5586

5586

>>5585 |

| >> | No. 5587

5587

>>5586 |

| >> | No. 5588

5588

>>5585 |

| >> | No. 5589

5589

>>5588 |

| >> | No. 5590

5590

>>5589 |

| >> | No. 5591

5591

It's expected that Gideon will announce in the Budget this week that people with an annuity already in place will be able to cash it in from next year. |

| >> | No. 5592

5592

>>5591 |

| >> | No. 5593

5593

>>5592 |

| >> | No. 5594

5594

>>5593 |

| >> | No. 5595

5595

>>5594 |

| >> | No. 5596

5596

>>5595 |

| >> | No. 5597

5597

>>5594 |

| >> | No. 5598

5598

An investigation has been launched into claims the details of millions of people's pensions are being sold to fraudsters and cold-calling firms. |

| >> | No. 5599

5599

>>5598 |

| >> | No. 5600

5600

Why is cold calling legal anyway? |

| >> | No. 5601

5601

>>5600 |

| >> | No. 5602

5602

>>5601 |

| >> | No. 5603

5603

>>5602 |

| >> | No. 5604

5604

>>5603 |

| >> | No. 5605

5605

>>5604 |

| >> | No. 5606

5606

>>5605 |

| >> | No. 5607

5607

>>5606 |

| >> | No. 5608

5608

>>5607 |

| >> | No. 5610

5610

>>5602 |

| >> | No. 5612

5612

>>5599 |

| >> | No. 5613

5613

>>5612 |

| >> | No. 5614

5614

>>5613 |

| >> | No. 5615

5615

Is it really going to fuel a BTL boom? |

| >> | No. 5616

5616

>>5595 |

| >> | No. 5618

5618

>>5616 |

| >> | No. 5623

5623

>>5613>>5614 |

| >> | No. 5638

5638

The Work & Pensions Select Committee have proposed increasing the age from which you can access your private pension benefits to 5 years below State Pension Age, so in a few years it'll go from 55 as it is now to 61 if they get their way. It wasn't that long ago you can access them from age 50. |

| >> | No. 5639

5639

28DE84EB00000578-3088131-image-a-10_1432066140137.jpg   The Mail, Telegraph and Mirror are all advocating for the over 55s to make pension contributions with the intention of cashing it in in the near future to take advantage of tax relief and the new rules. |

| >> | No. 5640

5640

Also, I've just noticed that the Daily Mail infographic is wrong for the higher rate taxpayer. If they paid in £600 then tax relief on the contribution would gross it up to £750 and they'd be able to claim a tax refund (or adjustment to their tax code) of £150 through their self assessment. |

| >> | No. 5641

5641

>>5640 |

| >> | No. 5642

5642

The Daily Mail are reporting that Mumsnet are still mad at being forced to pay pension contributions for their nannies because of auto-enrolment. |

| >> | No. 5643

5643

>>5642 |

| >> | No. 5644

5644

>>5643 |

| >> | No. 5645

5645

>>5641 |

| >> | No. 5646

5646

>>5644 |

| >> | No. 5647

5647

>>5644 |

| >> | No. 5648

5648

>>5647 |

| >> | No. 5649

5649

>>5648 |

| >> | No. 5654

5654

Fraudsters are posing as members of Pension Wise, i.e. the governments free guidance service, to con people out of their money. |

| >> | No. 5655

5655

>>5654 |

| >> | No. 5656

5656

>>5655 |

| >> | No. 5657

5657

>>5656 |

| >> | No. 5658

5658

>>5657 |

| >> | No. 5659

5659

>>5658 |

| >> | No. 5660

5660

>>5657 |

| >> | No. 5661

5661

Scottish Widows have revealed that they've had 185,000 enquiries since the pension freedoms came into effect, of which 70% (just under 130,000) entirely cashed their pension in. The average pot cashed in was below £20,000. |

| >> | No. 5680

5680

Pensions freedoms in CRISIS. |

| >> | No. 5685

5685

>>5680 |

| >> | No. 5686

5686

Would now be a good time to switch more of my pension into funds investing in Europe or should I wait until the shit hits the fan more? |

| >> | No. 5687

5687

>>5686 |

| >> | No. 5688

5688

>>5687 |

| >> | No. 5689

5689

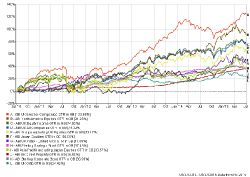

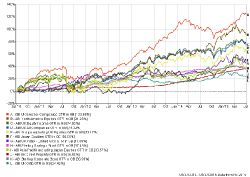

genChart.png   Actually, although most equity sectors have fallen 4-6% over the last month, it's not significant enough to warrant messing around with my investment strategy in the hopes of exploiting a fall in the market. |

| >> | No. 5690

5690

>>5689 |

| >> | No. 5691

5691

>>5690 |

| >> | No. 5692

5692

>>5691 |

| >> | No. 5693

5693

genChart.png   >>5692 |

| >> | No. 5694

5694

Unsurprisingly, the removal of the 55% tax charge on lump sum death benefits for crystallised funds/funds held by those over 75 means that more people are planning on using their pension as a vehicle to pass on their estate and potentially avoid Inheritance Tax. |

| >> | No. 5695

5695

I have no idea why the Guardian have called this a raid on pension pots, but it looks like the Government are going to reduce the amount of tax relief available on contributions by additional rate taxpayers. |

| >> | No. 5696

5696

Osborne hinted today that he's considering scrapping tax relief on pension contributions and making income taken out free from tax. In effect, they'll be like ISAs you can't access until you're old but you'll be able to benefit from employer contributions and the tax efficient growth of pension funds. |

| >> | No. 5697

5697

>>5696 |

| >> | No. 5719

5719

I'm not entirely sure what they're getting at, but the Guardian are trying to claim the fact that men are more likely to save into a pension than women is evidence of the gender pay gap. |

| >> | No. 5720

5720

>>5719 |

| >> | No. 5721

5721

>>5720 |

| >> | No. 5722

5722

Which? are claiming that those taking advantage of the pensions freedoms with a new flexi-access drawdown plan face a 'lottery' of whether they get ripped off by their provider because the system is 'madly complex'. |

| >> | No. 5723

5723

>>5719 |

| >> | No. 5724

5724

>>5723 |

| >> | No. 5725

5725

>>5722 |

| >> | No. 5726

5726

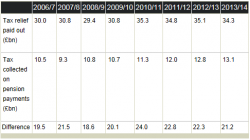

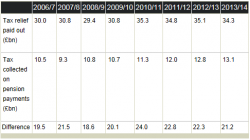

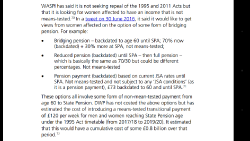

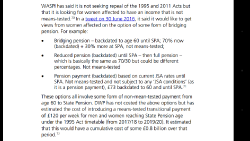

Capture.png   I read something in the FT today saying they're expecting the consultation on tax relief on pension contributions means that it'll be scrapped completely. |

| >> | No. 5727

5727

>>5726 |

| >> | No. 5728

5728

>>5727 |

| >> | No. 5731

5731

Research by PwC finds that giving pensions the same tax regime as ISAs is more popular than the current system. They found that most people don't actually understand the current system, but would rather they were taxed while they were still working than in retirement. |

| >> | No. 5753

5753

The Mail are stepping up their campaign about the new State Pension and how the government announcements about it have been misleading due to the number of people whom won't recieve the full amount. |

| >> | No. 5755

5755

Just started a new job in the NHS. My wages are being garnished for an NHS pension. Not sure if I want to stay in the NHS. Should I opt-out of the pension scheme? |

| >> | No. 5756

5756

>>5755 |

| >> | No. 5757

5757

>>5755 |

| >> | No. 5758

5758

>>5755 |

| >> | No. 5760

5760

>>5758 |

| >> | No. 5762

5762

>>5756 |

| >> | No. 5763

5763

The Tax Incentivised Savings Association (TISA) has recommended to Osborne's green paper "Strengthening the incentive to save: a consultation on pensions tax relief" that employers and employees should be dissuaded from using the, er, tax incentivised saving of salary sacrifice arrangements in order for the Treasury to raise greater revenue. I'm not entirely sure they've grasped what they're supposed to stand for. |

| >> | No. 5764

5764

Can anyone else hear the prerecorded phone messages already? |

| >> | No. 5765

5765

>>5758 |

| >> | No. 5766

5766

>>5765 |

| >> | No. 5767

5767

>>5765 |

| >> | No. 5768

5768

>>5765 |

| >> | No. 5769

5769

>>5768 |

| >> | No. 5771

5771

>>5770 |

| >> | No. 5772

5772

>>5771 |

| >> | No. 5773

5773

>>5772 |

| >> | No. 5775

5775

The Grauniad are scaremongering that there has been a COLLAPSE in the average contributions to company pension schemes, from 9.1% to 4.7%, and have speculated it's because greedy employers are being tightfisted when the reality is that 2.5million people have been automatically enrolled into a workplace pension scheme, many with initial contributions starting at 1% employer, 1% employee gross, which is bound to bring the average down. |

| >> | No. 5776

5776

>>5775 |

| >> | No. 5777

5777

>>5776 |

| >> | No. 5778

5778

Ros Altmann's response to all the criticism about the new flat-rate State Pension can be summarised as "Shurrup, you'll be better off. Besides, don't blame me - it's the fault of that Lib Dem, Steve Webb." |

| >> | No. 5779

5779

>>5776 |

| >> | No. 5780

5780

>>5779 |

| >> | No. 5781

5781

Gideon has announced that the 89 Local Authority pension schemes are to be merged into six wealth funds, with assets of over £25billion each, so the funds can be utilised for British infrastructure projects. Quite a shrewd way to boost spending, really. |

| >> | No. 5782

5782

Robert-Maxwell-001.jpg   >>5781 |

| >> | No. 5783

5783

>>5782 |

| >> | No. 5784

5784

>>5783 |

| >> | No. 5794

5794

>>5784 |

| >> | No. 5813

5813

Two pension threads, but this one has the words "public sector" in recent replies so I figure I'll get a better answer in this one. |

| >> | No. 5814

5814

>>5813 |

| >> | No. 5815

5815

>>5814 To add to this: |

| >> | No. 5839

5839

7c9f9c4b-b17a-49a7-a8d3-72a7733ae684-1020x678.png   The CPI was -0.1% in September, which just happens to be the month they use to measure future increases to the ISA allowance and public sector pension increases. Funny that. |

| >> | No. 5860

5860

1464.jpg   The DWP have unveiled a monster called Workie that's meant to warn small employers they'll need to automatically enrol their workers in a pension scheme. Presumably this has come about due to the increasing number of enforcement actions issued by The Pensions Regulator and the number of whistleblowers reporting non- compliance by their employers. |

| >> | No. 5891

5891

>Most workers reaching retirement will be worse off under the new universal state pension, expected to be set at £155 a week, according to a highly critical analysis of secretary of state Iain Duncan Smith’s flagship policy. |

| >> | No. 5892

5892

>>5891 |

| >> | No. 5893

5893

>>5892 |

| >> | No. 5894

5894

>>5893 |

| >> | No. 5895

5895

>>5894 |

| >> | No. 5896

5896

They've announced today that a decision on tax relief on pension contributions, which was anticipated to be made during the Autumn Statement, has been pushed back to the 2016 Budget. |

| >> | No. 5904

5904

>>5860 |

| >> | No. 6018

6018

ChartBuilder.png   I'm thinking about switching 10-15% of my pension pot into BlackRock Gold & General, which has returned just over -63% over the past 5 years. Is this a stupid idea? Buy low, sell high and all that. Gold and mining won't keep tumbling forever. |

| >> | No. 6031

6031

Steve Webb has said Pension Wise, the free guidance service from the government, has been a massive waste of money after it's emerged that it has cost nearly £40 million so far and it has only given guidance to about 18,000 people. Effectively around £2,000 for each piece of guidance given and research has indicated around 40% of these have said the service was of very little or no use to them. I've also read that demand has been so low that many staff have been redeployed within CAB and other places so they actually have something to do. |

| >> | No. 6047

6047

>>5839 |

| >> | No. 6048

6048

>>6047 |

| >> | No. 6049

6049

>>6048 |

| >> | No. 6050

6050

Workers in the UK will have the worst pensions of any major economy and the oldest official retirement age of any country, according to the Organisation for Economic Cooperation and Development. |

| >> | No. 6051

6051

>>6050 |

| >> | No. 6052

6052

>>6050 |

| >> | No. 6053

6053

>>6052 |

| >> | No. 6054

6054

>>6053 |

| >> | No. 6055

6055

>>6054 |

| >> | No. 6056

6056

>>6054 |

| >> | No. 6057

6057

>>6055 |

| >> | No. 6058

6058

>>6057 |

| >> | No. 6059

6059

>>6058 |

| >> | No. 6060

6060

>>6059 |

| >> | No. 6061

6061

>>6060 |

| >> | No. 6062

6062

>>6053 |

| >> | No. 6063

6063

>>6062 |

| >> | No. 6064

6064

>>6062 |

| >> | No. 6066

6066

I've heard there's a group of women, calling themselves Women Against State Pension Inequality or something, and they're positively furious that they haven't actually paid attention during the past 20 years or so about the State Pension Age for women being brought in line with that for men and it's only just dawned on them now that they won't receive it at age 60 so they are demanding that the government puts all women born after 6 April 1951 in the same position had they been born before 5 April 1950, i.e. they want their State Pension backdating/bringing forward to age 60. |

| >> | No. 6099

6099

>At least 16 million people under the age of 43 will be worse off as a result of the new “flat rate” state pension, new figures released by the Government have revealed. |

| >> | No. 6100

6100

>>6099 |

| >> | No. 6101

6101

>>6100 |

| >> | No. 6102

6102

>>6101 |

| >> | No. 6103

6103

>>6101 |

| >> | No. 6104

6104

>>6102 |

| >> | No. 6105

6105

>>6104 |

| >> | No. 6106

6106

>>6105 |

| >> | No. 6107

6107

>>6106 |

| >> | No. 6108

6108

>>6107 |

| >> | No. 6109

6109

>>6108 |

| >> | No. 6111

6111

>Pension tax perks for higher earners are set to be abolished in George Osborne’s March Budget as the chancellor pitches a pension overhaul towards swing voters on lower incomes. |

| >> | No. 6113

6113

>>6111 |

| >> | No. 6128

6128

>>6111 |

| >> | No. 6139

6139

Up to four million people retiring from April are at risk of receiving an incorrect amount of state pension because their incomes are being calculated using data "riddled" with errors, The Telegraph has learned. |

| >> | No. 6140

6140

Whoops. Accidentally deleted >>6114, which was: |

| >> | No. 6157

6157

Steve Webb is claiming that Osborne is planning on scrapping tax relief on contributions and being able to take a 25% tax free lump sum at retirement. If that happens then the only incentive to save in a pension will be employer contributions. He's going to make himself so unpopular that he'll never replace Cameron |

| >> | No. 6158

6158

>>6157 |

| >> | No. 6159

6159

>>6158 |

| >> | No. 6167

6167

>>6158 |

| >> | No. 6168

6168

>>6159 |

| >> | No. 6169

6169

>>6168 |

| >> | No. 6170

6170

How much money do I have to save to not die? |

| >> | No. 6171

6171

>>6168 |

| >> | No. 6172

6172

>>6170 |

| >> | No. 6173

6173

>George Osborne is set to abandon a planned raid on middle-class pensions in the face of a Tory backlash. |

| >> | No. 6174

6174

>>6173 |

| >> | No. 6175

6175

ChartBuilder.png   >>6018 |

| >> | No. 6176

6176

There's a nice little bonus in the budget for savers - the lifetime ISA. You can contribute up to £4000 per year and get a 25% bonus if you use the money to pay for a house or withdraw it after the age of 60. |

| >> | No. 6177

6177

>>6176 |

| >> | No. 6178

6178

>>6176 |

| >> | No. 6179

6179

>>6178 |

| >> | No. 6180

6180

>>6176 |

| >> | No. 6181

6181

|

| >> | No. 6182

6182

>>6181 |

| >> | No. 6183

6183

>>6182 |

| >> | No. 6184

6184

>>6183 |

| >> | No. 6185

6185

>>6184 |

| >> | No. 6186

6186

>>6185 |

| >> | No. 6187

6187

>>6186 |

| >> | No. 6188

6188

>>6183 |

| >> | No. 6189

6189

>>6182 |

| >> | No. 6190

6190

>>6189 |

| >> | No. 6481

6481

The government has said a pledge to keep the “triple lock” on the state pension will remain in place for the rest of this parliament, after Ros Altmann argued the policy should be abandoned after 2020. |

| >> | No. 6484

6484

>>6481 |

| >> | No. 6485

6485

>>6484 |

| >> | No. 6486

6486

>>6485 |

| >> | No. 6487

6487

>>6486 |

| >> | No. 6488

6488

>>6487 |

| >> | No. 6489

6489

>>6488 |

| >> | No. 6490

6490

>Millions of workers could be denied flexible access to their final salary pension pots if a radical shake-up to let companies ditch pension promises made to staff is passed by the Government. |

| >> | No. 6529

6529

To the surprise of no one, except the media and the Labour party, the majority of people using flexi-access drawdown are being prudent about the level of income they are taking. |

| >> | No. 6530

6530

>>6529 |

| >> | No. 6531

6531

>>6530 |

| >> | No. 6532

6532

FTSE 100 companies reporting pension deficits paid out 25% more in dividends than their combined deficit |

| >> | No. 6533

6533

>>6532 |

| >> | No. 6534

6534

>>6533 |

| >> | No. 6535

6535

>>6534 |

| >> | No. 6659

6659

At an event during the Labour conference Steve McCabe, on the work and pensions committee, has suggested changing pensions tax relief so it favours young people more. |

| >> | No. 6660

6660

>>6659 |

| >> | No. 6661

6661

>>6660 |

| >> | No. 6662

6662

>>6661 |

| >> | No. 6663

6663

>>6662 |

| >> | No. 6664

6664

>>6663 |

| >> | No. 6665

6665

>>6664 |

| >> | No. 6666

6666

>>6664 |

| >> | No. 6667

6667

>>6666 |

| >> | No. 6668

6668

>>6667 |

| >> | No. 6669

6669

>>6668 |

| >> | No. 6670

6670

Debbie Abrahams, shadow work and pension secretary by virtue of being able to fill a vacancy after Angela Rayner was moved to shadow education secretary as a result of the mass cabinet resignations, has declared at the Labour conference today that they would introduce a socialist pension system if they were in power. |

| >> | No. 6671

6671

>>6670 |

| >> | No. 6672

6672

>>6671 |

| >> | No. 6673

6673

Tory conference time. Richard Harrington, pensions minister and property developer, has suggested that, like the Lifetime ISA, people should be able to use their pensions to fund a property purchase. Now that's a turn up for the books. |

| >> | No. 6674

6674

John Glen, the parliamentary private secretary to Philip Hammond was asked at an event today whether there will be a change to the pension tax relief system in the Autumn Statement. He's said that it's a very real possibility because it will fit in with Theresa May's plans on assisting working people on low incomes and this would be evidence of that they're actually doing something with these intentions. |

| >> | No. 6675

6675

>>6674 |

| >> | No. 6676

6676

>>6675 |

| >> | No. 6679

6679

The work and pensions secretary, Damian Green, has thrown his weight behind proposals for a new State Pension system where you reach State Pension age after building up 45 years of NI credits - someone leaving school at 18 could get their State Pension at 63 whereas someone going to university could have to wait until they were 66/67. |

| >> | No. 6680

6680

shit.jpg   >>6679 |

| >> | No. 6696

6696

927084-System__Resources__Image-1088760.jpg   Pension news: |

| >> | No. 6697

6697

>>6696 |

| >> | No. 6698

6698

>>6679 |

| >> | No. 6699

6699

Screenshot_2016-10-25-20-30-21.png   >>6697 |

| >> | No. 6738

6738

The government may be preparing to increase the official state pension age to 70 for millions of people currently in their 20s, a former minister has claimed. |

| >> | No. 6739

6739

>>6738 |

| >> | No. 6740

6740

>>6739 |

| >> | No. 6741

6741

>>6739 |

| >> | No. 6742

6742

>>6741 |

| >> | No. 6743

6743

>>6742 |

| >> | No. 6794

6794

>>6743 |

| >> | No. 6795

6795

>>6794 |

| >> | No. 6796

6796

>>6795 |

| >> | No. 6797

6797

>>6796 |

| >> | No. 6798

6798

>>6796 |

| >> | No. 6836

6836

It costs just £34 to get £100 added to pension savings |

| >> | No. 6837

6837

>>6836 |

| >> | No. 6838

6838

>>6837 |

| >> | No. 6839

6839

>>6838 |

| >> | No. 6855

6855

>Former Chancellor George Osborne is to augment his lucrative private sector income by taking a role with the world's biggest asset manager. |

| >> | No. 6990

6990

Lads. I'm pretty sure the age of retirement will be raised in the 4 decades before I reach 70. I was thinking of opting out of my civil service pensions. I kind of need the little bit they deduct from me every month and I'm pretty sure I won't reach retirement age after the raise it again anyway. Is there any point anymore? |

| >> | No. 6992

6992

>>6990 |

| >> | No. 6994

6994

>>6990 |

| >> | No. 6995

6995

>>6994 |

| >> | No. 6996

6996

How do civil service pensions work? What makes them so great? |

| >> | No. 6997

6997

>>6996 |

| >> | No. 7067

7067

>Six million men and women will have to wait a year longer than they expected to get their state pension, the government has announced. |

| >> | No. 7068

7068

>>7067 |

| >> | No. 7069

7069

>>7068 |

| >> | No. 7070

7070

>>7068 |

| >> | No. 7071

7071

>>7070 |

| >> | No. 7072

7072

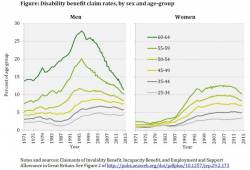

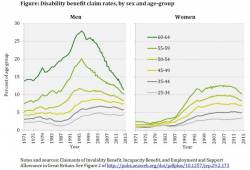

OBS_Disability benefits recipients_Fig_web.jpg   >>7071 |

| >> | No. 7073

7073

>>7071 |

| >> | No. 7074

7074

The pension system is a literal ponzi scheme that might blow up at any moment |

| >> | No. 7076

7076

>>7073 |

| >> | No. 7078

7078

>>7076 |

| >> | No. 7079

7079

>>7078 |

| >> | No. 7080

7080

>>7076 |

| >> | No. 7184

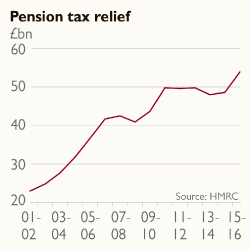

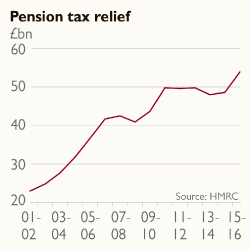

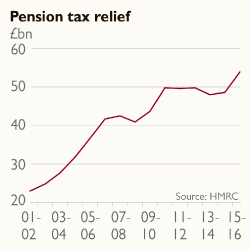

7184

methode/times/prod/web/bin/79418f36-aad7.png

Savers may face a fresh raid on pensions as the cost of tax relief passed £50 billion for the first time. |

| >> | No. 7221

7221

Can someone please explain this to me? I don't understand it. |

| >> | No. 7222

7222

>>7221 |

| >> | No. 7223

7223

>>7221 |

| >> | No. 7224

7224

>>7222 |

| >> | No. 7225

7225

>>7224 |

| >> | No. 7226

7226

>The British arm of Toys R Us faces being plunged into administration within the next 48 hours, risking the loss of up to 3,200 jobs, after the UK’s pension lifeboat fund indicated that it would block a restructuring proposal for the ailing business. |

| >> | No. 7227

7227

>>7226 |

| >> | No. 7260

7260

>>7227 |

| >> | No. 7261

7261

>>7260 |

| >> | No. 7262

7262

>>7261 |

| >> | No. 7264

7264

whsmith.png

>>7261 |

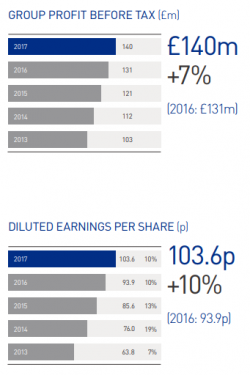

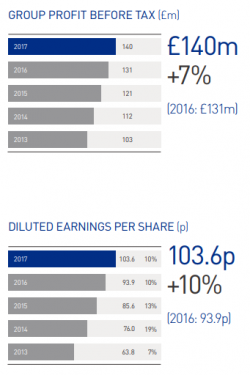

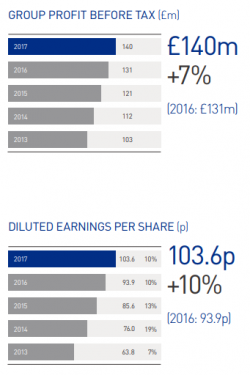

| >> | No. 7265

7265

We had a thread about Smiths shortly after Christmas. They're maintaining the same level of profit off declining sales, through ripping people off, particularly from their monopoly at places like train stations. |

| >> | No. 7266

7266

2F644f26ae-af84-11e7-8f75-2b6f1159f66f.png

>>7265 |

| >> | No. 7267

7267

>>7261 |

| >> | No. 7268

7268

>>7267 |

| >> | No. 7269

7269

>>7268 |

| >> | No. 7270

7270

>>7269 |

| >> | No. 7271

7271

>>7270 |

| >> | No. 7272

7272

>>7269 |

| >> | No. 7273

7273

1559239732.jpg

>>7272 |

| >> | No. 7274

7274

>>7270 |

| >> | No. 7275

7275

>>7274 |

| >> | No. 7276

7276

>>7273 |

| >> | No. 7277

7277

>>7274 |

| >> | No. 7278

7278

>>7268 |

| >> | No. 7279

7279

>>7278 |

| >> | No. 7280

7280

>>7279 |

| >> | No. 7281

7281

I visited a Halfords today and then searched on Amazon for the same things - almost half price and it is much easier to enter your reg number and see what fits. I think they're next. |

| >> | No. 7282

7282

>>7279 |

| >> | No. 7283

7283

>>7282 |

| >> | No. 7284

7284

>>7283 |

| >> | No. 7285

7285

>>7284 |

| >> | No. 7286

7286

>>7284 |

| >> | No. 7287

7287

>>7286 |

| >> | No. 7288

7288

>>7287 |

| >> | No. 7289

7289

71HTQXDwByL._SX524_.jpg

Old fashioned key cutting is on the way out anyway (at least when it comes to your front door key.) |

| >> | No. 7290

7290

>>7289 |

| >> | No. 7291

7291

>>7290 |

| >> | No. 7292

7292

Pensions? You lads have got little interest in discussing them. Where Timpsons may branch out into next and what the future holds for the business of cutting keys? That's certainly got the juices flowing. |

| >> | No. 7293

7293

>>7289 |

| >> | No. 7294

7294

>>7292 |

| >> | No. 7295

7295

>>7294 |

| >> | No. 7296

7296

>>7295 |

| >> | No. 7297

7297

>>7292 |

| >> | No. 7298

7298

>>7297 |

| >> | No. 7299

7299

>>7295 |

| >> | No. 7300

7300

>>7297 |

| >> | No. 7301

7301

>>7300 |

| >> | No. 7302

7302

>>7300 |

| >> | No. 7303

7303

>>7302 |

| >> | No. 7304

7304

>>7302 |

| >> | No. 7305

7305

>>7303 |

| >> | No. 7337

7337

>>7265 |

| >> | No. 7375

7375

>A TV advertising campaign to warn the public about pension scams is being launched by UK regulators as new figures show that victims are losing an average of £91,000 each. |

| >> | No. 7376

7376

>>7375 |

| >> | No. 7377

7377

>>7337 |

| >> | No. 7378

7378

>>7376 |

| >> | No. 7387

7387

Life savings shot down in pensions ‘Wild West’ |

| >> | No. 7390

7390

Women under the age of 35 on average have more saved in a pension than men. |

| >> | No. 7391

7391

>>7390 |

| >> | No. 7394

7394

>>7391 |

| >> | No. 7398

7398

61u1vHXBpAL._SX425_.png

>>7394 |

| >> | No. 7399

7399

>>7398 |

| >> | No. 7400

7400

>>7399 |

| >> | No. 7421

7421

Happy State Pension Equality Day, lads. |

| >> | No. 7453

7453

Pension contribution hike to hit pay packets |

| >> | No. 7455

7455

>>7453 |

| >> | No. 7456

7456

>>7455 |

| >> | No. 7457

7457

I'm leaving my job soon and have a pension scheme with them. When I join my new job, can the new employers just garnish my salary and pay into my old scheme? Or do I have to transfer the funds from my old scheme to my new scheme? |

| >> | No. 7458

7458

>>7457 |

| >> | No. 7459

7459

>>7456 |

| >> | No. 7460

7460

>>7459 |

| >> | No. 7461

7461

I'm not sure why this is being painted as a bad thing as the other anon said. |

| >> | No. 7462

7462

>>7460 |

| >> | No. 7463

7463

>>7461 |

| >> | No. 7483

7483

>>7458 |

| >> | No. 7484

7484

>>7483 |

| >> | No. 7486

7486

>>7484 |

| >> | No. 7487

7487

>>7486 |

| >> | No. 7491

7491

>>7488>>7490 |

| >> | No. 7500

7500

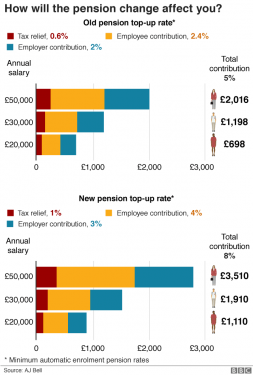

_106314988_pensions_640-nc.png

Happy auto-enrolment increase day, lads. |

| >> | No. 7501

7501

A&Es could close or be forced to operate without enough staff because of pension rules, doctors have warned. |

| >> | No. 7609

7609

>>7501 |

| >> | No. 7616

7616

>>7609 |

| >> | No. 7617

7617

>>7616 |

| >> | No. 7618

7618

D9_0Cb-XYAMp44K.png   >>7616 |

| >> | No. 7642

7642

UK's renting millennials face homelessness crisis when they retire |

| >> | No. 7643

7643

>>7617 |

| >> | No. 7644

7644

>>7642 |

| >> | No. 7645

7645

>>7644 |

| >> | No. 7647

7647

>>7644 |

| >> | No. 7648

7648

>>7647 |

| >> | No. 7649

7649

>>7647 |

| >> | No. 7650

7650

>>7648 |

| >> | No. 7651

7651

>>7650 |

| >> | No. 7652

7652

>>7650 |

| >> | No. 7654

7654

>>7650 |

| >> | No. 7655

7655

>>7650 |

| >> | No. 7656

7656

AnnuitiesGilts.jpg

>>7655 |

| >> | No. 7657

7657

>>7656 |

| >> | No. 7658

7658

>>7657 |

| >> | No. 7659

7659

>>7658 |

| >> | No. 7660

7660

>>7659 |

| >> | No. 7661

7661

Savers moved £34 billion out of final salary pension schemes last financial year, more than double the amount transferred in the previous 12 months. |

| >> | No. 7688

7688

Iain-Duncan-Smith.jpg   IDS wants to increase the State Pension age to 75, so that the elderly can 'access the benefits of work' arising from 'gainful and life enhancing employment.' |

| >> | No. 7689

7689

>>7688 |

| >> | No. 7692

7692

>>7689 |

| >> | No. 7693

7693

>>7692 |

| >> | No. 7694

7694

>>7693 |

| >> | No. 7695

7695

>>7694 |

| >> | No. 7696

7696

>>7692 |

| >> | No. 7697

7697

2AE0762600000578-3175967-image-a-45_1438000128635.jpg   >>7688 |

| >> | No. 7698

7698

>>7693 |

| >> | No. 7699

7699

>>7698 |

| >> | No. 7700

7700

>>7696 |

| >> | No. 7701

7701

>>7697 |

| >> | No. 7703

7703

Horrifying-Uplift-1024x512.jpg   >>7701 |

| >> | No. 7704

7704

>>7703 |

| >> | No. 7705

7705

>>7704 |

| >> | No. 7740

7740

Women not entitled to pension age change compensation, high court rules |

| >> | No. 7741

7741

>>7740 |

| >> | No. 7742

7742

You shouldn't be able to raise the pension age without announcing it 40+ years in advance. |

| >> | No. 7743

7743

3346.jpg

>>7741 |

| >> | No. 7744

7744

>>7743 |

| >> | No. 7745

7745

>>7743 |

| >> | No. 7746

7746

Old people have it too good, with or without a couple of extra years at work. Fuck em. |

| >> | No. 7747

7747

>>7745 |

| >> | No. 7748

7748

>>7747 |

| >> | No. 7749

7749

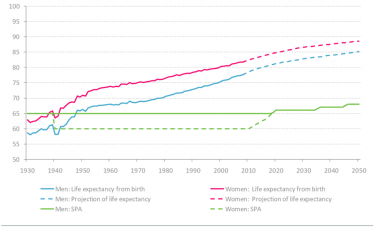

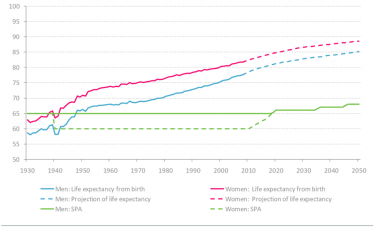

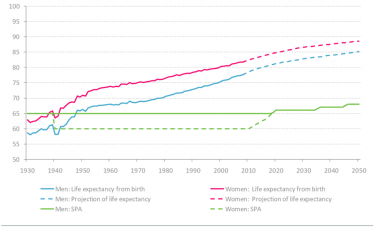

Rising-life-expectancy-and-changes-to-state-pensio.png

>>7748 |

| >> | No. 7750

7750

>>7749 |

| >> | No. 7751

7751

>>7747 |

| >> | No. 7752

7752

What was the reasoning behind women getting their pensions earlier in the first place? |

| >> | No. 7753

7753

>>7752 |

| >> | No. 7754

7754

>>7752 |

| >> | No. 7755

7755

>>7754 |

| >> | No. 7756

7756

>>7751 |

| >> | No. 7757

7757

>>7756 |

| >> | No. 7758

7758

>>7757 |

| >> | No. 7759

7759

>>7758 |

| >> | No. 7760

7760

>>7759 |

| >> | No. 7761

7761

>>7760 |

| >> | No. 7762

7762

>>7761 |

| >> | No. 7763

7763

Let's just skip to the part where we discuss which WASPI is the filthiest in bed. |

| >> | No. 7764

7764

My mother is one of the women affected. I've given her notice that I intend to ask her opinion on the matter at Christmas 2021, just to make sure she knows in good time. |

| >> | No. 7765

7765

>>7764 |

| >> | No. 7766

7766

>>7765 |

| >> | No. 7767

7767

>>7766 |

| >> | No. 7771

7771

>>7765 |

| >> | No. 7772

7772

>>7767 |

| >> | No. 7799

7799

19811216-7581745-By_setting_out_the_income_needed_.jpg

Save in your pension or it's Tesco own brand orange juice and furniture from Wilko for you! |

| >> | No. 7800

7800

>>7799 |

| >> | No. 7801

7801

>>7800 |

| >> | No. 7802

7802

>>7800 |

| >> | No. 7803

7803

>>7799 |

| >> | No. 7804

7804

>>7803 |

| >> | No. 7805

7805

>>7799 |

| >> | No. 7806

7806

Heating will be banned by the time we get old. |

| >> | No. 7807

7807

>>7806 |

| >> | No. 7808

7808

>>7807 |

| >> | No. 7809

7809

>>7808 |

| >> | No. 7810

7810

Well I don't know about you lot but I'm winning the Euromillions tomorrow anyway, so it won't matter. |

| >> | No. 7811

7811

>>7810 |

| >> | No. 7812

7812

>>7811 |

| >> | No. 7813

7813

>>7812 |

| >> | No. 7833

7833

Rejoice, lads. The Vanguard SIPP is finally here. |

| >> | No. 7834

7834

>>7833 |

| >> | No. 7835

7835

>>7833 |

| >> | No. 7836

7836

>>7834 |

| >> | No. 7874

7874

The IFS have suggested that too many low earners might be contributing to a pension scheme, worried that they shouldn't be reducing their earnings. |

| >> | No. 7962

7962

I've got about one-fifth of my pension in a gold fund[1] that has gone up by almost 60% in six months thanks to coronavirus. Do I cash out or not? The only thing I can think of switching into at the minute is an infrastructure fund[2] or perhaps pumping more into UK equities because it hasn't bounced back the way the rest of the world as a whole has. |

| >> | No. 7963

7963

>>7962 |

| >> | No. 7964

7964

>>7963 |

| >> | No. 7965

7965

>>7962 |

| >> | No. 7975

7975

The Court of Appeal have rejected the challenge from WASPI to be compensated for the female State Pension age increasing from 60. |

| >> | No. 8006

8006

Got my annual pension statement today. Apparently my pot could be worth £105,000 at retirement, which will provide me with a whopping £220 per month. |

| >> | No. 8007

8007

>>8006 |

| >> | No. 8008

8008

>>8007 |

| >> | No. 8184

8184

I've got roughly £39,000 in my pension and there's around £245 a month going in. I've been having a play around with a calculator and that's suggesting if contributions kept at that rate until State Pension age (35½ years away?) I'd have a pot of just over £280,000 in today's terms. |

| >> | No. 8185

8185

>>8184 |

| >> | No. 8186

8186

Halifax have cut the interest rate on my help to buy ISA twice in the past year, I'm fairly sure. I find myself wondering what the point was if they can just arbitrarily decide "actually no, fuck you, you're getting a percent and that's it." I mean, I'm sort of committed to that account now given I've already got about four grand in it. |

| >> | No. 8187

8187

>>8186 |

| >> | No. 8188

8188

>>8186 |

| >> | No. 8189

8189

>>8186 |

| >> | No. 8575

8575

>The amount the government has to spend on state pensions will fall by £1.5bn by 2022, partly because of over-65s dying of Covid, forecasts suggest. The government will also receive an extra £0.9bn from inheritance tax, partly due to Covid-related deaths. |

| >> | No. 8726

8726

The comedy memecoins I mined over a hungover weekend back in 2013 are now massively outperforming my pension. |

| >> | No. 8727

8727

tulip-mania-a-prints.jpg

>>8726 |

| >> | No. 8728

8728

>>8727 |

| >> | No. 8733

8733

>>8726 |

| >> | No. 8734

8734

>>8575 |

| >> | No. 8745

8745

>>8733 |

| >> | No. 8871

8871

>Rishi Sunak is considering blocking a near 6% rise in old-age pension payments as part of a wider effort to rein in the cost of Prime Minister Boris Johnson's spending, the Sunday Times newspaper said. Under a pension promise in the Conservative Party's 2019 election campaign, state pensions are meant to rise each year by the highest of the annual inflation rate, wage growth or 2.5%. |

| >> | No. 8873

8873

>>8871 |

| >> | No. 8874

8874

>>8873 |

| >> | No. 8875

8875

>>8874 |

| >> | No. 8876

8876

>>8875 |

| >> | No. 8878

8878

>>8874 |

| >> | No. 8944

8944

The government has confirmed a one-year suspension of the "triple lock" formula for annual state pension increases. The move follows government concern that a big post-pandemic rise in average earnings would have meant pensions increasing by 8%. |

| >> | No. 8945

8945

>>8944 |

| >> | No. 8946

8946

>>8945 |

| >> | No. 8970

8970

>>8946 |

| >> | No. 8971

8971

>>8970 |

| >> | No. 8972

8972

>>8970 |

| >> | No. 8973

8973

>>8970 |

| >> | No. 8974

8974

>>8973 |

| >> | No. 8975

8975

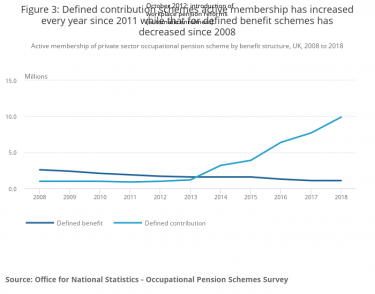

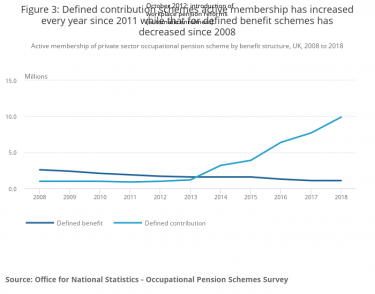

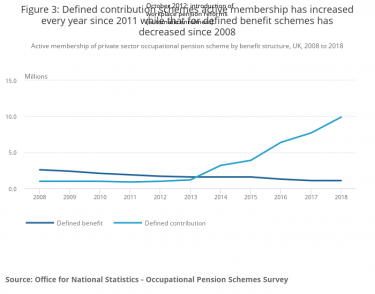

Figure 3_ Defined contribution schemes active memb.png

>>8974 |

| >> | No. 8976

8976

>>8975 |

| >> | No. 8977

8977

>>8976 |

| >> | No. 9000

9000

>A single person will need post-tax annual income of £10,900 for a minimum standard of living in retirement, academics have estimated. That spending budget increases to £16,700 for a couple, the calculations for The Pensions and Lifetime Savings Association (PLSA) suggest. |

| >> | No. 9001

9001

>>9000 |

| >> | No. 9003

9003

>>9001 |

| >> | No. 9004

9004

>>9001 |

| >> | No. 9005

9005

Pensions seems pointless now. People should be allowed to take all of it out without any tax penalties at any age. Imagine still renting when you are a pensioner and trying to survive on scraps. I would rather use it to buy a house, and then maybe beg on the streets in my 80s. |

| >> | No. 9006

9006

>>9005 |

| >> | No. 9007

9007

>>9005 |

| >> | No. 9008

9008

>>9007 |

| >> | No. 9010

9010

>>9007 |

| >> | No. 9040

9040

>The Government has launched a statutory review into increasing the state pension age, potentially pushing retirement back for millions of people. |

| >> | No. 9041

9041

>>9040 |

| >> | No. 9042

9042

>>9041 |

| >> | No. 9043

9043

>>9041 |

| >> | No. 9044

9044

>>9042 |

| >> | No. 9045

9045

>>9043 |

| >> | No. 9046

9046

|

| >> | No. 9047

9047

>>9045 |

| >> | No. 9083

9083

I've got about £45k in a couple of old workplace pension schemes. How do I figure out the best place to move them? |

| >> | No. 9084

9084

>>9083 |

| >> | No. 9085

9085

>>9084 |

| >> | No. 9105

9105

>>9085 |

| >> | No. 9192

9192

As a basic rate taxpayer is there any point in me paying more into a pension than any employer matching? Salary sacrifice isn't an option. |

| >> | No. 9225

9225

>>9083 here again. |

| >> | No. 9227

9227

>>9225 |

| >> | No. 9228

9228

linechart (1).png

>>9227 |

| >> | No. 9257

9257

Fuck it. I've set up an account with AJ Bell and requested the transfer of my Aviva pensions with them. I just need to hope things go down rather than up over the next 2-4 weeks whilst I'm out of the market. |

| >> | No. 9258

9258

>>9257 |

| >> | No. 9259

9259

>>9258 |

| >> | No. 9260

9260

>>9259 |

| >> | No. 9520

9520

>Spiralling inflation, volatile financial markets and the soaring cost of living are leading to the “great unretirement”, with research suggesting retired people are returning to the workplace. |

| >> | No. 9634

9634

So me and the wife collectively earn just over £100k. Before you think we're rolling in it, we live in the capital so the money doesn't go as far and the mortgage is crippling us. That said, with a nipper on the way, apparently we get less help because of our collective earnings, in terms of child benefit and the prospective 30 hours free childcare. |

| >> | No. 9635

9635

>>9634 |

| >> | No. 9636

9636

>>9634 |

| >> | No. 9643

9643

Anyone else slightly concerned by the pensions announcement in the Budget? They're scrapping the lifetime allowance but are freezing the amount of tax free cash you can take to £268,275, which was 25% of the allowance. It feels like this is a slippery slope and in a few years they'll start revising this downwards until they decide you can only take out £20,000 out tax free or something. |

| >> | No. 9653

9653

Capture1.png

Decided to let the Muzzies run my pension. You know what they say: past performance is a guarantee of future performance. |

| >> | No. 9654

9654

>>9653 |

| >> | No. 9655

9655

>>9654 |

| >> | No. 9656

9656

>>9655 |

| >> | No. 9657

9657

>>9656 |

| >> | No. 9658

9658

>>9657 |

| >> | No. 9781

9781

Would it make sense to pay off as little as possible on a mortgage and instead overpay into a pension to use a tax-free lump sum at 55/57 to clear the mortgage then? |

| >> | No. 9782

9782

>>9781 |

| >> | No. 9783

9783

>>9782 |

| >> | No. 9784

9784

>>9781 |

| >> | No. 9785

9785

>>9784 |

| >> | No. 9786

9786

Another point I forgot to make, endowment funds would have to pay tax internally deemed equivalent to basic rate tax that you wouldn't have with a pension (or ISAs and GIAs) so if a pension fund returned 5% then the same fund in an endowment would return 4%. |

| >> | No. 9795

9795

79747553-12933185-image-a-5_1704718719295.png

Looks like Lidl's on the menu, lads. |

| >> | No. 9796

9796

>>9795 |

| >> | No. 9797

9797

Transferred my SIPP to Interactive Investor for their cashback offer, but it looks like the S&P500 going up while I was out the market for two weeks has more than wiped that out. |

| >> | No. 9870

9870

I have some money in a Standard Life pension. I'm not building it and there's not enough in there to justify its existence - is there any way I can withdraw the capital? |

| >> | No. 9871

9871

>>9870 |

| >> | No. 9872

9872

When you get sacked, do you still pay pension contributions on your final pay? |

| >> | No. 9876

9876

There's a lot of bright ideas floating around at the minute. |

| >> | No. 9877

9877

>>9876 |

| >> | No. 9917

9917

I just had a look at my pension. In 2055, I will have an annual income of around £17,000 a year, including the state pension. My rewards from my career will be about £5000 a year. Obviously I'll be able to live cheaply once I've paid off my mortgage, but fucking hell. Pensions are such a bloody scam. Considering what inflation will do to an income of 17 grand a year in a little over 30 years, I don't see why I'm bothering. |

| >> | No. 9918

9918

>>9917 |

| >> | No. 10121

10121

>Denmark is set to have the highest retirement age in Europe after its parliament adopted a law raising it to 70 by 2040. Since 2006, Denmark has tied the official retirement age to life expectancy and has revised it every five years. It is currently 67 but will rise to 68 in 2030 and to 69 in 2035. The retirement age at 70 will apply to all people born after 31 December 1970. |

| >> | No. 10122

10122

>>10121 |

| >> | No. 10123

10123

>>10121 |

| >> | No. 10145

10145

>People retiring in 2050 will be worse off than pensioners today, the government has warned, unless action is taken to boost retirement savings. |

| >> | No. 10146

10146

>>10145 |

| >> | No. 10147

10147

>>10146 |

| >> | No. 10148

10148

>>10146 |

| >> | No. 10149

10149

>>10148 |

| >> | No. 10150

10150

>>10149 |

[ Return ] [ Entire Thread ] [ First 100 posts ] [ Last 50 posts ]

|

Delete Post [] Password |