[ Return ] [ Entire Thread ] [ First 100 posts ] [ Last 50 posts ]

| >> | No. 7541

7541

One of the UK's most high profile stock-pickers has suspended trading in his largest fund as rising numbers of investors ask for their money back. Neil Woodford said after "an increased level of redemptions", investors would not be allowed to "redeem, purchase or transfer shares" in the fund. |

| >> | No. 7542

7542

>>7541 |

| >> | No. 7543

7543

>>7542 |

| >> | No. 7544

7544

>>7542 |

| >> | No. 7545

7545

>>7544 |

| >> | No. 7546

7546

>>7544 |

| >> | No. 7547

7547

>>7545 |

| >> | No. 7548

7548

>>7546 |

| >> | No. 7549

7549

>>7548 |

| >> | No. 7550

7550

>>7549 |

| >> | No. 7551

7551

>>7550 They will be getting their money back |

| >> | No. 7552

7552

>>7551 |

| >> | No. 7553

7553

>>7552 I'm guessing not, given that question. |

| >> | No. 7554

7554

>>7553 |

| >> | No. 7555

7555

>>7554 |

| >> | No. 7556

7556

>>7555 |

| >> | No. 7557

7557

>>7556 |

| >> | No. 7558

7558

>>7557 |

| >> | No. 7559

7559

888.jpg

>>7557 |

| >> | No. 7560

7560

>>7559 |

| >> | No. 7561

7561

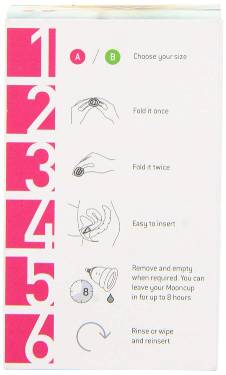

71ToiQKjnML._SL1500_.jpg

>>7560 |

| >> | No. 7562

7562

>>7561 |

| >> | No. 7563

7563

Bloody women. Always wanting something for nothing. |

| >> | No. 7564

7564

>>7563 |

| >> | No. 7565

7565

bjwwihJ.jpg

>>7562 |

| >> | No. 7566

7566

>>7563 |

| >> | No. 7567

7567

Back when I was a lad, you could get condoms for free from a few places - the GP, the GUM clinic, the counsellor at school - usually a big bowl of Pasante johnnies you could just take whenever you popped in. I'm fairly surprised there's not a similar system for blob rags by now, you'd think there would be. |

| >> | No. 7568

7568

>>7564 |

| >> | No. 7569

7569

>>7568 |

| >> | No. 7570

7570

>>7569 |

| >> | No. 7572

7572

>>7570 |

| >> | No. 7573

7573

>>7567 |

| >> | No. 7574

7574

>>7573 |

| >> | No. 7575

7575

>>7573 |

| >> | No. 7576

7576

>>7564 |

| >> | No. 7577

7577

If poor women are going to spend all their money on smoking 50 fags a day you'd think they'd have the sense to collect up all their used tabs, tape them together and use them as tampons. The filters would work great as a period blood absorber. |

| >> | No. 7578

7578

Maybe Brighthouse should start doing a giant crate of tampons instead of all those giant flat screen televisions they sell to povvos. |

| >> | No. 7579

7579

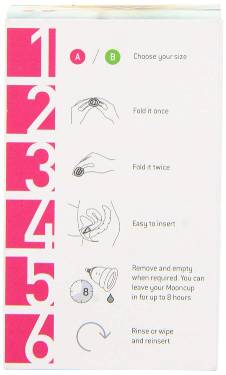

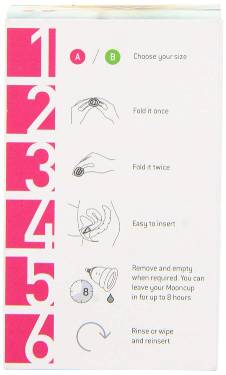

Hmm, mooncups are unreasonably cheap. Do they really have to fold? Can you just ram a gold (plated) egg cup up there? |

| >> | No. 7580

7580

What we need to do is create a black market in tampons. |

| >> | No. 7581

7581

Are you sating we need a massive tampon tax, which you'll then bypass for fun & profit? |

| >> | No. 7582

7582

If we're all done being shitty edgelords, "period poverty" is mainly about access, and in this country it's typically only a problem in the Adam Johnson demographic. As a result, schools and colleges are being encouraged to supply sanitary products for their students. |

| >> | No. 7583

7583

>>7582 |

| >> | No. 7584

7584

>>7582 |

| >> | No. 7585

7585

>>7582 |

| >> | No. 7586

7586

>>7582 |

| >> | No. 7587

7587

>>7584 |

| >> | No. 7588

7588

>>7587 |

| >> | No. 7589

7589

>>7588 |

| >> | No. 7590

7590

>>7589 |

| >> | No. 7591

7591

>>7590 |

| >> | No. 7592

7592

>>7591 |

| >> | No. 7593

7593

>>7591 |

| >> | No. 7594

7594

>>7593 |

| >> | No. 7595

7595

>>7592 |

| >> | No. 7596

7596

https___d1e00ek4ebabms.cloudfront.net_production_c.png

>People with pensions and savings invested in Neil Woodford's now suspended flagship fund have expressed concern over how it was promoted. |

| >> | No. 7597

7597

>>7596 Surely he's pulled enough out over the years that he can just make a few gestures then walk away leaving some other sap to manage the decline? |

| >> | No. 7598

7598

>>7597 |

| >> | No. 7599

7599

>>7598 |

| >> | No. 7600

7600

linechart.png   >>7599 |

| >> | No. 7601

7601

I've been in on a meeting with members of Woodford's team. They've confirmed that:- |

| >> | No. 7602

7602

>>7601 |

| >> | No. 7604

7604

Financial Conduct Authority boss Andrew Bailey said fund rules may need amending in the wake of the Woodford fund suspension. In a letter penned for the Financial Times, Bailey said the suspension of the £3.7 billion fund last Monday had raised important questions about the UK’s regulatory approach towards investment in illiquid assets. |

| >> | No. 7606

7606

>>7602 |

| >> | No. 7608

7608

linechart.png   As expected... |

| >> | No. 7662

7662

It's now expected to open in December at the earliest. |

| >> | No. 7673

7673

>One of the UK's most high-profile stockpickers |

| >> | No. 7675

7675

linechart.png   >>7673 |

| >> | No. 7676

7676

>>7675 |

| >> | No. 7677

7677

>>7675 |

| >> | No. 7678

7678

>>7676 |

| >> | No. 7679

7679

>>7678 |

| >> | No. 7680

7680

>>7679 |

| >> | No. 7681

7681

>>7680 |

| >> | No. 7682

7682

>>7681 |

| >> | No. 7683

7683

>>7682 |

| >> | No. 7684

7684

>>7680 |

| >> | No. 7706

7706

Speaking of the cult of personality... |

| >> | No. 7709

7709

>>7706 |

| >> | No. 7710

7710

>>7709 |

| >> | No. 7711

7711

>>7706 |

| >> | No. 7712

7712

>>7709 |

| >> | No. 7713

7713

>>7712 |

| >> | No. 7717

7717

>>7710 |

| >> | No. 7718

7718

>>7717 |

| >> | No. 7797

7797

Neil Woodford’s stricken equity income fund to be shut down |

| >> | No. 7798

7798

He's thrown his toys out of the pram about being dismissed from his flagship fund by leaving the other two funds he ran. |

| >> | No. 7897

7897

Lads what do all your stocks and shares look like? |

| >> | No. 7898

7898

>>7897 |

| >> | No. 7899

7899

>>7898 |

| >> | No. 7900

7900

>>7897 |

| >> | No. 7901

7901

>>7899 |

| >> | No. 7902

7902

>>7901 |

| >> | No. 7903

7903

>>7901 |

| >> | No. 7904

7904

>>7900 |

| >> | No. 7905

7905

>>7902 |

| >> | No. 7906

7906

>>7905 |

| >> | No. 7908

7908

>>7897 |

| >> | No. 7909

7909

>>7906 |

| >> | No. 7930

7930

I'm looking at funds on the Vanguard website right now and there's a boggling array to choose from. How exactly do you go about picking the right one? I'm assuming if you've only got around 5k to invest then you're better off on the riskier side of the spectrum? |

| >> | No. 7932

7932

>>7930 |

[ Return ] [ Entire Thread ] [ First 100 posts ] [ Last 50 posts ]

|

Delete Post [] Password |