[ Return ] [ Entire Thread ] [ First 100 posts ] [ Last 50 posts ]

| >> | No. 8117

8117

Several lads here seem to have a grasp of investments and so on. Do any of you have a regular income outside "earner income"? What kind of category does it fall into, and how did you come into it? |

| >> | No. 8118

8118

There seems to be a growing trend for people wanting to do "side-hustles" or to live off passive income, but if r/UKPersonalFinance is anything to go by these tend to be people earning <£22k or with about a grand in cash they want to generate an income from. The reality is most of these people would be far better served putting that effort into maximising their salary. |

| >> | No. 8119

8119

>>8118 |

| >> | No. 8120

8120

>>8119 |

| >> | No. 8121

8121

>>8119 |

| >> | No. 8122

8122

>>8118 |

| >> | No. 8123

8123

>>8119 |

| >> | No. 8124

8124

>>8123 |

| >> | No. 8125

8125

>>8124 |

| >> | No. 8126

8126

>>8125 |

| >> | No. 8128

8128

>>8123 |

| >> | No. 8130

8130

>>8126 |

| >> | No. 8131

8131

>>8126 |

| >> | No. 8132

8132

>>8123 |

| >> | No. 8133

8133

>>8132 |

| >> | No. 8134

8134

>>8133 |

| >> | No. 8135

8135

>>8132 |

| >> | No. 8136

8136

>>8134 |

| >> | No. 8137

8137

>>8136 |

| >> | No. 8138

8138

>>8125 |

| >> | No. 8139

8139

>>8138 |

| >> | No. 8140

8140

>>8139 |

| >> | No. 8141

8141

>>8136 |

| >> | No. 8142

8142

>>8139 |

| >> | No. 8143

8143

>>8141 |

| >> | No. 8144

8144

>>8138 |

| >> | No. 8145

8145

>>8144 |

| >> | No. 8146

8146

>>8144 |

| >> | No. 8147

8147

>>8146 |

| >> | No. 8148

8148

>>8144 |

| >> | No. 8149

8149

>>8148 |

| >> | No. 8150

8150

>>8148 |

| >> | No. 8152

8152

>>8147 |

| >> | No. 8153

8153

>>8152 |

| >> | No. 8154

8154

>>8152 |

| >> | No. 8155

8155

>>8154 |

| >> | No. 8156

8156

You lot are talking about complicated stuff, but I would like your thoughts on something. I have about £18,000 just resting in a savings account. I have been meaning to stick it in a stocks & shares ISA to buy into a index tracker of sorts. Is that advisable? |

| >> | No. 8157

8157

>>8154 |

| >> | No. 8158

8158

>>8157 |

| >> | No. 8159

8159

>>8156 |

| >> | No. 8160

8160

>>8159 |

| >> | No. 8161

8161

>>8159 |

| >> | No. 8162

8162

>>8161 |

| >> | No. 8163

8163

>>8160 |

| >> | No. 8164

8164

>>8163 |

| >> | No. 8165

8165

If you're going to pick funds then the key thing is to understand what you're actually investing in rather and why you've chosen those funds than following what everyone else seems to be doing. Otherwise when things get choppy you'll start to panic. |

| >> | No. 8168

8168

>>8165 |

| >> | No. 8169

8169

>>8168 |

| >> | No. 8170

8170

>>8168 |

| >> | No. 8171

8171

In b4 it's in the news that millions gets pumped into Games Workshop because you nerds decide to invest in your hobbies. |

| >> | No. 8172

8172

>>8171 |

| >> | No. 8174

8174

>>8172 |

| >> | No. 8175

8175

>>8171 |

| >> | No. 8176

8176

>>8175 |

| >> | No. 8177

8177

>>8176 |

| >> | No. 8178

8178

>>8177 |

| >> | No. 8179

8179

>>8178 |

| >> | No. 8180

8180

>>8176 |

| >> | No. 8181

8181

>>8179 |

| >> | No. 8182

8182

>>8181 |

| >> | No. 8183

8183

>>8182 |

| >> | No. 8196

8196

My Stobart investment has roughly doubled in value. What stupid company should I reinvest the gains into? |

| >> | No. 8200

8200

>>8196 |

| >> | No. 8204

8204

>>8200 |

| >> | No. 8214

8214

>>8200 |

| >> | No. 8215

8215

>>8214 |

| >> | No. 8216

8216

I was doing really well from my Blackberry trade then fucked it all up by buying Bionano Genomics high. I'm one of the poor retail meme investors that you richlads are being judgy about. |

| >> | No. 8217

8217

>>8216 |

| >> | No. 8218

8218

>>8217 |

| >> | No. 8221

8221

>>8152 |

| >> | No. 8222

8222

>>8215 |

| >> | No. 8223

8223

>>8218 |

| >> | No. 8224

8224

GME short squeeze hit today. Might not be over yet. |

| >> | No. 8225

8225

>>8224 |

| >> | No. 8226

8226

>>8225 |

| >> | No. 8227

8227

>>8226 |

| >> | No. 8228

8228

>>8226 |

| >> | No. 8229

8229

>>8225 |

| >> | No. 8230

8230

>>8229 |

| >> | No. 8231

8231

>>8230 |

| >> | No. 8232

8232

>>8229 |

| >> | No. 8233

8233

>>8232 continued |

| >> | No. 8234

8234

Got a spare few hundred bob. I'd not planned on looking into trading until the house was sorted, and nothing short term, but lurking wsb has basically just been for the craic until this point. Now I feel like I just want to walk into the casino with £500 and leave my card at home. |

| >> | No. 8235

8235

>>8234 |

| >> | No. 8236

8236

>>8235 |

| >> | No. 8237

8237

>>8236 |

| >> | No. 8238

8238

The ~£221 in my Trading212 account on Friday is now up to ~£262 at the minute. Lads, how do I stop myself from getting carried away and pumping all of my cash holdings into shares I know nothing about? |

| >> | No. 8239

8239

>>8238 |

| >> | No. 8240

8240

>>8239 |

| >> | No. 8241

8241

>>8240 |

| >> | No. 8242

8242

Had $8 left in my Revolut, so bought some GME. I have no idea what I'm doing, but if I can turn it into £20 then curly wurlies are on me. |

| >> | No. 8243

8243

>>8242 |

| >> | No. 8244

8244

>>8239 |

| >> | No. 8245

8245

I've got about £75 spare. Do I join the GME train or have I left it too late? I decided against it on Friday afternoon when it was at about $60 and I do have a habit of thinking I've missed the boat followed by things continuing to go up and up. |

| >> | No. 8246

8246

Can't even afford half a share as that's currently £110. |

| >> | No. 8247

8247

>>8246 |

| >> | No. 8248

8248

>>8247 |

| >> | No. 8249

8249

It's down. They can't cope with demand. |

| >> | No. 8250

8250

>>8242 |

| >> | No. 8251

8251

>>8249 |

| >> | No. 8252

8252

>>8250 |

| >> | No. 8253

8253

>>8245 |

| >> | No. 8254

8254

>>8252 |

| >> | No. 8255

8255

I'm not involved but it seems that now is the worst time to get involved because the whole internet is getting excited about this shit. |

| >> | No. 8256

8256

>>8254 |

| >> | No. 8257

8257

>>8256 |

| >> | No. 8258

8258

Sorry ignore me, I'm being an idiot and forgot what shorting means. They have to buy the stock back at a loss and that will drive it higher. |

| >> | No. 8259

8259

>>8256 |

| >> | No. 8260

8260

I'm going to split what I was going to put in GME 50:50 into two of these. Which should I go for:- |

| >> | No. 8261

8261

>>8259 |

| >> | No. 8262

8262

>>8260 |

| >> | No. 8263

8263

>>8260 |

| >> | No. 8265

8265

>>8260 |

| >> | No. 8266

8266

>>8260 |

| >> | No. 8267

8267

>>8266 |

| >> | No. 8268

8268

>>8263>>8264 |

| >> | No. 8269

8269

>>8266 |

| >> | No. 8270

8270

>>8266 |

| >> | No. 8271

8271

>>8267 |

| >> | No. 8272

8272

Robinhood is trending as they've apparently stopped individual investors buying GME and a bunch of others that have been shorted. |

| >> | No. 8273

8273

>>8272 |

| >> | No. 8274

8274

>>8272>>8273 |

| >> | No. 8275

8275

>>8274 |

| >> | No. 8276

8276

>>8275 |

| >> | No. 8277

8277

>>8275 |

| >> | No. 8278

8278

>>8277 |

| >> | No. 8279

8279

>>8277 |

| >> | No. 8280

8280

Fuck it, I'm doubling down on BB and putting some in Nokia because they've mainly crashed as Seppos can't trade them on the likes of Robinhood. |

| >> | No. 8281

8281

>>8279 |

| >> | No. 8282

8282

>>8280 |

| >> | No. 8283

8283

I need to get in on this but I'm lazy and I'd probably fuck it up. |

| >> | No. 8284

8284

>>8282 |

| >> | No. 8285

8285

I put a few quid into ETH and doge coins. All these redditors with newfound fortunes are going to do something with the money they don't immediately spend on vinyl figurines. Not a terrible bet that they'll go up. |

| >> | No. 8286

8286

>>8285 |

| >> | No. 8287

8287

You're watching history in the making here lads. |

| >> | No. 8288

8288

Seems as though Robinhood is maybe selling people's stocks against their will. |

| >> | No. 8289

8289

The thing I've found out with this, or at least when things are as volatile as they are, is that you need to make snap decisions, and you need to give it basically undivided attention. Thinking of putting another tenner into GME even though I'm down at the moment because surely the angry reddit septics will find a way to buy it, and when they do, we can upgrade to a box of Celebrations... each. |

| >> | No. 8290

8290

>>8288 |

| >> | No. 8291

8291

>>8290 |

| >> | No. 8292

8292

So, uh .. how do you buy and sell crypto coins? |

| >> | No. 8293

8293

>>8292 |

| >> | No. 8294

8294

It's quite disheartening to think, the same people who pumped and dumped throughout the crash with impunity and generally profited on human misery for decades, will be pressuring for market reform overnight because Reddit made one stock into a meme. And they'll get it. |

| >> | No. 8295

8295

>>8294 |

| >> | No. 8296

8296

>>8295 |

| >> | No. 8297

8297

>>8296 |

| >> | No. 8298

8298

>>8295 |

| >> | No. 8299

8299

It tickles me that the /r/Stonks lot seem to think that the suspension of GME on Robinhood is some kind of conspiracy, rather than a completely routine response to weird trading. They might not believe it, but Robinhood is acting in the interests of their customers by refusing to execute really stupid transactions - anyone going long on GME in the last few days is on the losing end of a Ponzi scheme. |

| >> | No. 8300

8300

>>8299 |

| >> | No. 8301

8301

>>8299 |

| >> | No. 8302

8302

>>8299 |

| >> | No. 8303

8303

>>8299 |

| >> | No. 8304

8304

I was right. The king of the reddit nerds pumped doge overnight so it tripled in value (for a bit). I was able to take out slightly more than I put in and still have more than that left in the account. |

| >> | No. 8305

8305

>>8304 |

| >> | No. 8306

8306

Sigh. |

| >> | No. 8307

8307

Decided to jump on the meme train overnight. Threw in £100. It's currently worth £56.08. When is this thing supposed to head for the moon again? |

| >> | No. 8308

8308

>>8307 |

| >> | No. 8310

8310

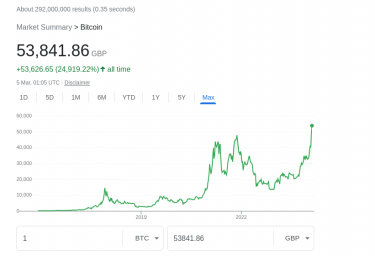

Elon Musk just changed his twitter bio to #Bitcoin |

| >> | No. 8311

8311

>>8307 |

| >> | No. 8313

8313

>>8311 |

| >> | No. 8314

8314

>>8313 |

| >> | No. 8315

8315

>>8310 |

| >> | No. 8316

8316

>>8315 |

| >> | No. 8317

8317

Apparently there's 11million options that expire on BlackBerry today if the share price is below $15 and hedge funds will have to pay out on all of them if the share price is at least $30. |

| >> | No. 8318

8318

Notification from T212 that they've enabled trading in GameStop and AMC today, but earning there could be lengthy execution disruptions to buy and sell orders. |

| >> | No. 8319

8319

Turns out FreeTrade have been waiting to validate me for over a year. Oops. |

| >> | No. 8320

8320

My DOGE have recovered to £72. I might actually get my original investment back by the end of today. |

| >> | No. 8321

8321

>>8316 |

| >> | No. 8322

8322

>>8319 |

| >> | No. 8323

8323

>>8322 |

| >> | No. 8324

8324

>>8320 |

| >> | No. 8325

8325

>>8322 |

| >> | No. 8326

8326

>>8323 |

| >> | No. 8327

8327

>>8319 |

| >> | No. 8328

8328

>>8326 |

| >> | No. 8329

8329

>>8325 |

| >> | No. 8330

8330

>>8328 |

| >> | No. 8331

8331

Nokia is up 10% today. The Milky Bars are on me. |

| >> | No. 8332

8332

>>8327 |

| >> | No. 8333

8333

>>8332 |

| >> | No. 8334

8334

>>8333 |

| >> | No. 8335

8335

If you aren't blocking ads you aren't even human. |

| >> | No. 8336

8336

>>8335 |

| >> | No. 8337

8337

>>8336 |

| >> | No. 8338

8338

>>8337 |

| >> | No. 8339

8339

>>8337 |

| >> | No. 8340

8340

My over 100% gain in BlackBerry on Wednesday has currently turned into a 3% loss on my investment. Fucking hell. |

| >> | No. 8341

8341

>>8340 |

| >> | No. 8342

8342

Not sure what to do with my Dogecoin now. I mined them at the start as part of the joke, and them got bored. |

| >> | No. 8343

8343

>>8342 |

| >> | No. 8344

8344

If I plan to cash out from this stocks trading and have only made a fiver, do I need to fill in any forms for HMRC? The US w8-ben form has already been filled in, so I don't think I need to declare anything else (i.e. below the CGT threshold). Can I just cash out and not worry? |

| >> | No. 8345

8345

https://globalfinancialdata.com/the-piggly-crisis |

| >> | No. 8346

8346

>>8344 |

| >> | No. 8347

8347

>>8342 |

| >> | No. 8348

8348

>>8347 |

| >> | No. 8349

8349

>>8348 |

| >> | No. 8352

8352

>>8349 |

| >> | No. 8353

8353

>>8352 |

| >> | No. 8354

8354

I know it's probably too late, but I think I'm going to try and buy the dip on GameStop tomorrow. |

| >> | No. 8355

8355

I sold 275 dogecoin last night and used the profit from that to buy 375 this morning. Is there any reason not to just keep doing that? |

| >> | No. 8356

8356

>>8354 |

| >> | No. 8357

8357

>>8346 |

| >> | No. 8358

8358

>>8356 |

| >> | No. 8359

8359

>>8357 |

| >> | No. 8360

8360

>>8357 |

| >> | No. 8361

8361

>>8360 |

| >> | No. 8362

8362

>>8361 |

| >> | No. 8363

8363

>>8358 |

| >> | No. 8364

8364

>>8363 |

| >> | No. 8367

8367

>>8363 |

| >> | No. 8368

8368

>>8367 |

| >> | No. 8369

8369

>>8368 |

| >> | No. 8370

8370

>>8369 |

| >> | No. 8372

8372

>>8370 |

| >> | No. 8373

8373

>>8364 |

| >> | No. 8374

8374

>>8369 |

| >> | No. 8375

8375

>>8374 |

| >> | No. 8376

8376

>>8369 |

| >> | No. 8378

8378

>>8373 |

| >> | No. 8380

8380

>>8375 |

| >> | No. 8381

8381

>>8369 |

| >> | No. 8382

8382

I've always been fond of the idea of limiting the transferability of shares, in principle, as a means to damp down speculation and promote taking a longer view of things. |

| >> | No. 8383

8383

Anyone know who's going to get fucked over first come NYSE opening? I just can't see all the big money not being able to profit out of this. |

| >> | No. 8384

8384

>>8382 Can exchanges not just apply a larger transaction fee? If a trade isn't worth making with a $0.10 trade, is it really worth making? |

| >> | No. 8385

8385

>>8382 |

| >> | No. 8386

8386

>>8382 |

| >> | No. 8387

8387

SEC reports over five million GME shares as fail-to-deliver in the first half of january. |

| >> | No. 8388

8388

>>8387 |

| >> | No. 8389

8389

>>8385 |

| >> | No. 8390

8390

>>8385 |

| >> | No. 8391

8391

>>8390 |

| >> | No. 8392

8392

>>8389 >>8390 >>8391 |

| >> | No. 8393

8393

>>8392 |

| >> | No. 8394

8394

>>8392 |

| >> | No. 8395

8395

>>8392 |

| >> | No. 8396

8396

SOMEONE FUCKING TELL BLACKBERRY NOT TO DROP BELOW $11 PER SHARE. |

| >> | No. 8397

8397

>>8396 |

| >> | No. 8398

8398

I've had to log out of my etoro account and I'm trying not to pay attention to the stock market (unsuccessfully) until the GME hype train dissipates. |

| >> | No. 8399

8399

>>8398 |

| >> | No. 8400

8400

>>8398 |

| >> | No. 8401

8401

Doge rallied overnight so I'm up £7. |

| >> | No. 8402

8402

>>8401 |

| >> | No. 8403

8403

>>8400 |

| >> | No. 8404

8404

>>8400 |

| >> | No. 8405

8405

>>8400 |

| >> | No. 8408

8408

>>8404 |

| >> | No. 8409

8409

The £15 total I put into GME was briefly just under £30 as I was selling small dips and buying small peaks, but then I stopped paying attention Monday and Tuesday and now it's about £7. Might as well go long now and maybe turn it back into £11-12. If not, whatever. |

| >> | No. 8410

8410

>>8409 |

| >> | No. 8411

8411

>>8409 |

| >> | No. 8412

8412

>>8411 |

| >> | No. 8413

8413

>>8412 |

| >> | No. 8414

8414

>>8408 |

| >> | No. 8415

8415

So I've been buying and selling the doge incrementally. I'll buy a couple of hundred then set it to sell when the price goes up 3-5 points, then buy back in when it goes down 3-5 points. Just enough to make a few coin profit on top of the transaction fees each time. |

| >> | No. 8416

8416

>>8414 |

| >> | No. 8417

8417

I don't get that people are complaining that they are going to lose money. You're not an expert trader, you're some ordinary slob, and the stock price will drop before you know what's happening. I though the whole point was to squeeze the shorts, not make money. People investing their college fund in GameStop? They're fucking insane. But kissing goodbye to a tenner in order to collectively fuck over some hedge funds? Absolutely that's worth it, isn't it? |

| >> | No. 8418

8418

>>8417 |

| >> | No. 8419

8419

>>8418 |

| >> | No. 8420

8420

>>8417 |

| >> | No. 8421

8421

>>8419 |

| >> | No. 8423

8423

Person who bought £100 worth of dogecoin, did you cash out? They're worth about 2.4x what you put in initially now. |

| >> | No. 8424

8424

>>8419 |

| >> | No. 8425

8425

>>8424 |

| >> | No. 8426

8426

>>8424 |

| >> | No. 8427

8427

Well, I'm glad the mainstream media has come to the rescue again, and delivered a nice comforting narrative that smooths over all the plot holes and leaves he pieces exactly where they were for next week's episode. |

| >> | No. 8428

8428

|

| >> | No. 8429

8429

>>8428 |

| >> | No. 8430

8430

This whole episode will have ruined thousands of lives and deluded thousands more they've somehow stuck it to the baddies. |

| >> | No. 8431

8431

>>8429 |

| >> | No. 8433

8433

>>8431 |

| >> | No. 8434

8434

>>8433 |

| >> | No. 8435

8435

Nothing on the Superbowl (obviously) but I did enjoy my dose of American commercialism. You really can't watch the Superbowl without the ads and a pizza. |

| >> | No. 8436

8436

>>8435 |

| >> | No. 8437

8437

>>8431 |

| >> | No. 8438

8438

I'd like to take my doge out of binance and put them on a memory stick somewhere so I'm not tempted to fiddle with them. What's the best way to go about this? |

| >> | No. 8439

8439

>>8438 |

| >> | No. 8440

8440

>>8439 |

| >> | No. 8472

8472

Looking at the daily charts for multiple coins, a lot of them seem to follow the same patterns. Not perfectly but all the big dips and peaks are there. Doesn't this make them effectively the same investment? |

| >> | No. 8473

8473

>>8472 |

| >> | No. 8474

8474

>>8473 |

| >> | No. 8475

8475

>>8473 |

| >> | No. 8495

8495

'Roaring Kitty' GameStop investor hit with lawsuit |

| >> | No. 8496

8496

>>8495 |

| >> | No. 8535

8535

GME shooting up again, was up 100% before close. |

| >> | No. 8536

8536

>>8535 |

| >> | No. 8537

8537

>>8535 |

| >> | No. 8538

8538

>>8496 |

| >> | No. 8539

8539

>>8538 |

| >> | No. 8540

8540

>>8539 |

| >> | No. 8541

8541

>>8540 |

| >> | No. 8542

8542

>>8540 |

| >> | No. 8543

8543

It's not real, there are no rules. |

| >> | No. 8544

8544

>>8541 |

| >> | No. 8545

8545

>>8544 |

| >> | No. 8546

8546

>>8545 |

| >> | No. 8547

8547

>>8545 |

| >> | No. 8548

8548

>>8547 |

| >> | No. 8549

8549

If Robinhood were unable to facilitate trades because it was economically unviable for them to do so, they would have said that. Instead they press released some bullshit about protecting their users. |

| >> | No. 8550

8550

>>8549 |

| >> | No. 8560

8560

shortlist.png   >>8439 |

| >> | No. 8563

8563

>>8560 |

| >> | No. 8574

8574

>>8563 |

| >> | No. 8576

8576

Someone I work with keeps pushing HBAR Hedera, saying its worth about $0.14 so I should put in £20 because it's about to pop. |

| >> | No. 8577

8577

>>8576 |

| >> | No. 8578

8578

>>8577 |

| >> | No. 8579

8579

>>8578 |

| >> | No. 8580

8580

>>8579 |

| >> | No. 8581

8581

Not financial advice: |

| >> | No. 8582

8582

5bb4f8f998a180339c3f0fa2.jpg   I feel like something fishy is going on. Like me you'll probably have an email invite from Deliveroo for their IPO because you've used them before that has been triggered by changes in UK law that allow the owner to overrule shareholder votes. |

| >> | No. 8583

8583

>>8582 |

| >> | No. 8584

8584

>>8582 |

| >> | No. 8585

8585

>>8582 |

| >> | No. 8586

8586

>>8583 |

| >> | No. 8587

8587

>>8586 |

| >> | No. 8588

8588

Not getting a straight answer here lads. I thought Deliveroo was worth a punt because the price always rises after an IPO, and they are continuing to do steady business during the pandemic. So what's the problem? |

| >> | No. 8589

8589

>>8588 |

| >> | No. 8590

8590

>>8589 |

| >> | No. 8591

8591

>>8588 |

| >> | No. 8593

8593

I'm waiting for the Vaccitech IPO. |

| >> | No. 8594

8594

>>8589 |

| >> | No. 8595

8595

So: Elon Musk and Jeff Bezos have a lot of wealth. They think the best use of it is to spend it on spaceships. This is "noble" or something. What's the best investment to get some of that drip down? |

| >> | No. 8596

8596

>>8595 |

| >> | No. 8597

8597

>>8595 |

| >> | No. 8598

8598

>>8597 |

| >> | No. 8599

8599

>>8598 |

| >> | No. 8600

8600

>>8599 |

| >> | No. 8601

8601

>>8599 |

| >> | No. 8602

8602

>>8601 |

| >> | No. 8603

8603

>>8602 |

| >> | No. 8604

8604

>>8603 |

| >> | No. 8605

8605

>>8601 |

| >> | No. 8606

8606

>>8601 |

| >> | No. 8607

8607

>>8604 |

| >> | No. 8610

8610

Oh dear, maybe it's not a good idea to put anything into the Deliveroo IPO after all. Lots of big players are staying away. |

| >> | No. 8611

8611

>>8598 |

| >> | No. 8612

8612

We do pretty well on building the satellites, many of them are built in Guildford, but we'll never be a viable launch site. |

| >> | No. 8613

8613

>>8611 |

| >> | No. 8614

8614

>>8610 |

| >> | No. 8615

8615

>>8610 |

| >> | No. 8616

8616

The shares I had in Aalberts Industries have gone up by almost 20% since I decided to sell them and double down on my losses in BlackBerry. I do not know what I am doing. |

| >> | No. 8617

8617

>Deliveroo shares drop 30% on stock market debut |

| >> | No. 8618

8618

>>8617 |

| >> | No. 8619

8619

>>8618 |

| >> | No. 8620

8620

>>8619 |

| >> | No. 8621

8621

>>8619 |

| >> | No. 8622

8622

>>8620 |

| >> | No. 8623

8623

>>8620 |

| >> | No. 8650

8650

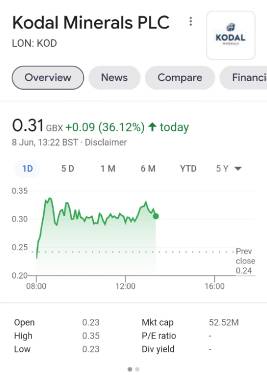

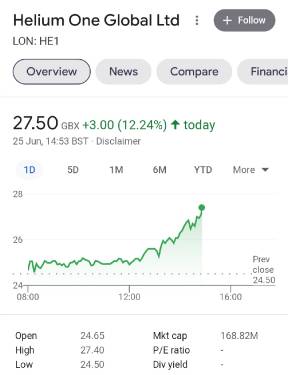

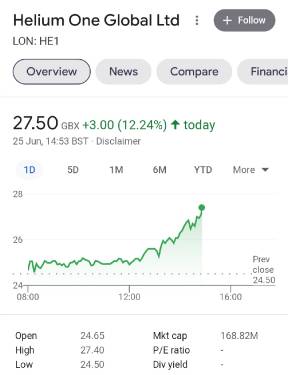

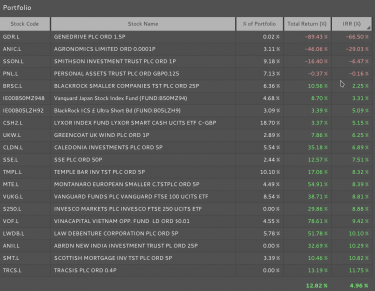

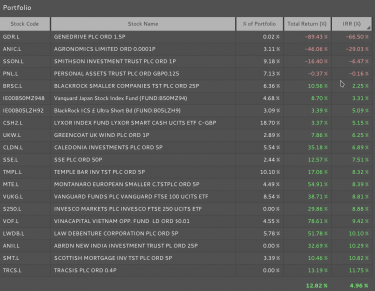

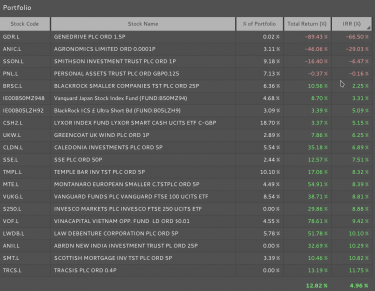

gainz.jpg

I'M ACTUALLY HOLDING SOMETHING THAT ISN'T AT A LOSS FOR ONCE. |

| >> | No. 8653

8653

>>8650 |

| >> | No. 8654

8654

>>8653 |

| >> | No. 8656

8656

>>8654 |

| >> | No. 8657

8657

>>8654 |

| >> | No. 8658

8658

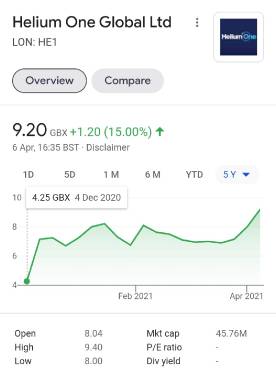

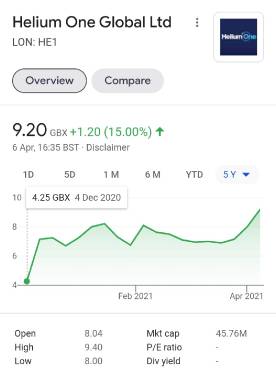

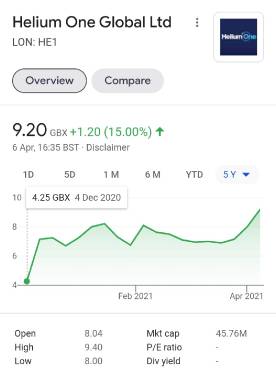

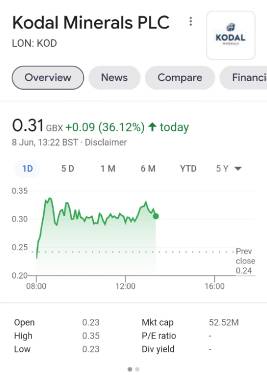

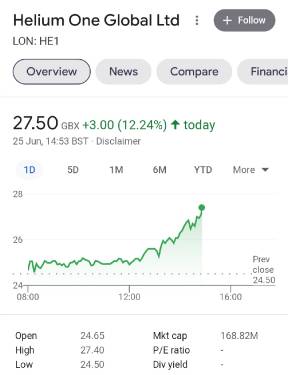

helium.jpg

>>8656 |

| >> | No. 8659

8659

>>8656 |

| >> | No. 8660

8660

>>8659 |

| >> | No. 8661

8661

>>8660 |

| >> | No. 8662

8662

>>8661 |

| >> | No. 8663

8663

>>8662 |

| >> | No. 8664

8664

>>8663 |

| >> | No. 8669

8669

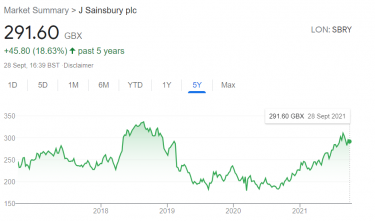

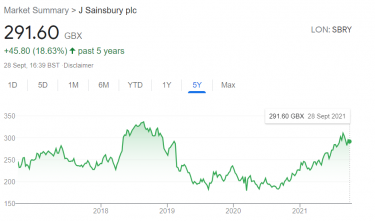

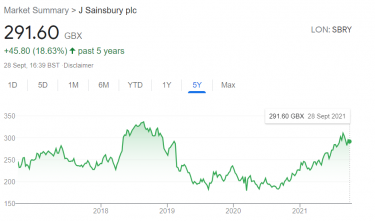

hlm.jpg

TOLD YOU, LADS. HELIUM IS GOING UP. |

| >> | No. 8670

8670

>>8669 |

| >> | No. 8671

8671

>>8670 |

| >> | No. 8672

8672

>>8670 |

| >> | No. 8673

8673

>>8672 |

| >> | No. 8675

8675

>>8672 |

| >> | No. 8676

8676

>>8675 |

| >> | No. 8678

8678

>>8673 |

| >> | No. 8685

8685

>>8673 |

| >> | No. 8719

8719

helium.jpg

HELIUM |

| >> | No. 8725

8725

Speaking of IPOs, what do you lads think about Darktrace which is expected to happen in the next few months? |

| >> | No. 8754

8754

Helium One shares have reached 20p today. I ruddy told you lads to get in, I told you. |

| >> | No. 8755

8755

>>8725 |

| >> | No. 8756

8756

Heliumsgoingup.jpg

Above 24p now. Helium, lads. |

| >> | No. 8757

8757

eachpushupconsistsofbothadownpartandanuppart.png

>>8756 |

| >> | No. 8758

8758

>>8757 |

| >> | No. 8759

8759

>>8758 |

| >> | No. 8765

8765

_118478577_optimised-us.inflation-nc.png

Hello, I would like it very much if I could stop losing money now. Everyone please stop spending money. |

| >> | No. 8766

8766

>>8765 |

| >> | No. 8767

8767

>>8766 |

| >> | No. 8768

8768

Today has been really good for me - lost a small amount yesterday, but it all came back today. Wish I had some more cash to buy.. |

| >> | No. 8812

8812

BlackBerry are up about 25% today so I'm up for the first time since the end of January/beginning of Feb. |

| >> | No. 8813

8813

>>8812 |

| >> | No. 8824

8824

Do LSE holdings tend to mirror the NYSE pattern of prices tanking just before an earnings report, and then even more still if the new is anything other than overwhelmingly positive? |

| >> | No. 8825

8825

>>8813 |

| >> | No. 8826

8826

>>8825 |

| >> | No. 8827

8827

>>8825 |

| >> | No. 8828

8828

Isn't Nokia just one of the WSB meme stocks? |

| >> | No. 8845

8845

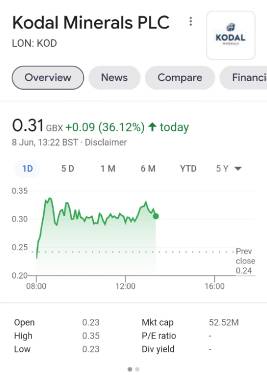

Kodal.jpg

Is anyone else in on plundering Africa for resources? All of that lithium in Mali isn't going to mine itself. |

| >> | No. 8846

8846

>>8845 |

| >> | No. 8847

8847

>>8846 |

| >> | No. 8848

8848

>>8847 |

| >> | No. 8849

8849

>>8848 |

| >> | No. 8850

8850

>>8845 |

| >> | No. 8851

8851

>>8850 |

| >> | No. 8870

8870

kodal.jpg

Told you lads. Plundering. |

| >> | No. 8886

8886

Helium.jpg

Helium continues to go up. |

| >> | No. 8887

8887

puntingHSS.png   Now this is a punt. |

| >> | No. 8888

8888

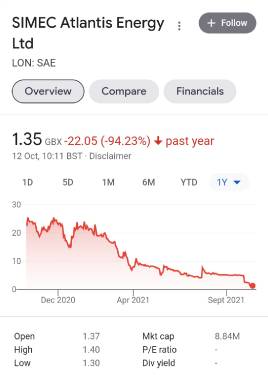

SIMEC.jpg

>>8887 |

| >> | No. 8889

8889

>>8888 |

| >> | No. 8890

8890

How do I invest in The Krypton Factor? |

| >> | No. 8891

8891

Careful with those investment lads, we're about to enter a period of Sonic Inflation. |

| >> | No. 8892

8892

>>8891 |

| >> | No. 8893

8893

>>8892 |

| >> | No. 8894

8894

>>8893 |

| >> | No. 8895

8895

>>8891 |

| >> | No. 8896

8896

Fintech, if you know what you are doing. Not Bitcoin or Doge, Etherium, slot machines. My friend made a killing on XRP. Look at the technology behind crypto and how it can be used non fiat - especially with inflation round the corner and dependency with online transactions post covid. Hang around with computer nerds and look to future proofing and how non fiat currencies are transacted without having a processor the size of a house. Start there. |

| >> | No. 8897

8897

>>8896 |

| >> | No. 8898

8898

>>8896 |

| >> | No. 8899

8899

>>8898 |

| >> | No. 8900

8900

>>8897 |

| >> | No. 8931

8931

Helno.jpg

Helium popped. |

| >> | No. 8932

8932

>>8931 |

| >> | No. 8933

8933

It's below 11p now. I think I need to resist the urge to double down. |

| >> | No. 8934

8934

>>8933 |

| >> | No. 8935

8935

>>8934 |

| >> | No. 8943

8943

>>8888 |

| >> | No. 8947

8947

Maybe I've spent too much time on r/UKPersonalFinance lately, but it seems like a substantial amount of members on the sub are complete retards. |

| >> | No. 8948

8948

>>8947 |

| >> | No. 8949

8949

>>8948 |

| >> | No. 8950

8950

>>8949 |

| >> | No. 8951

8951

>>8947 |

| >> | No. 8952

8952

>>8951 |

| >> | No. 8953

8953

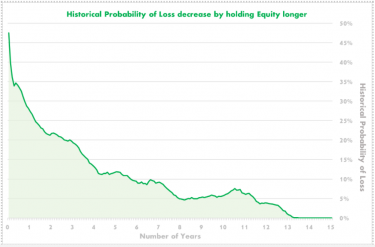

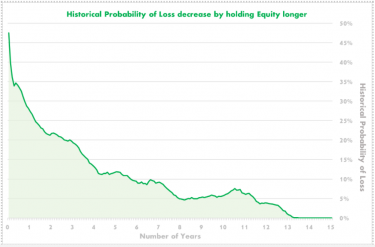

All my non-meme investments are the very Vanguard tracker funds that you're talking about. I put £5000 in two different ones, plus a hundred quid each every month, and they've made me about a grand since last year. I don't really know very much, but I plan to leave the money untouched until it's enough for my needs, and if it drops to nothing temporarily then rockets back up again, I'll be fine. I didn't even do that much research into which funds are best to invest in; I went FTSE because God save the Queen but that's most of my research right there. No gambling from me. |

| >> | No. 8954

8954

>>8953 |

| >> | No. 8955

8955

>>8953 |

| >> | No. 8956

8956

>>8953 |

| >> | No. 8957

8957

>>8956 |

| >> | No. 8963

8963

>>8957 |

| >> | No. 8964

8964

>>8963 |

| >> | No. 8965

8965

It's actually called optimising VWAP. |

| >> | No. 8966

8966

>>8965 |

| >> | No. 8967

8967

>>8966 |

| >> | No. 8968

8968

>>8967 |

| >> | No. 8969

8969

>>8968 |

| >> | No. 8978

8978

agronomics.png

Leonardo Dicaprio just invested in Mosa Meat: https://mosameat.com/blog/leonardo-dicaprio-invests-in-mosa-meat. |

| >> | No. 8979

8979

Where do you lads think I should put my paycheque now that the market's down? |

| >> | No. 8980

8980

>>8979 |

| >> | No. 8981

8981

>>8980 |

| >> | No. 8982

8982

>>8981 |

| >> | No. 8983

8983

>>8982 |

| >> | No. 8984

8984

>>8979 |

| >> | No. 8985

8985

>>8979 |

| >> | No. 8986

8986

I've been thinking of having a punt on an airline. Not sure which one yet though; they seem a safer bet as a recovery stock, than food & hospitality - not sure there are many obvious winners in that sector. |

| >> | No. 8987

8987

Untitled.png

>>8986 |

| >> | No. 8988

8988

>>8987 |

| >> | No. 8989

8989

>>8986 |

| >> | No. 8990

8990

>>8988 |

| >> | No. 8991

8991

Relaxed Monkey.png

Certainly a spooky old time on the markets isn't it. Hope you two aren't realising those losses. |

| >> | No. 8993

8993

simec.jpg

Widening losses, questions over the finances and the majority shareholder, time for me to go in and lose some money. |

| >> | No. 8994

8994

>>8993 |

| >> | No. 8995

8995

>>8993 |

| >> | No. 8996

8996

>>8995 |

| >> | No. 8997

8997

>>8995 |

| >> | No. 8998

8998

>>8997 |

| >> | No. 8999

8999

>>8997 |

| >> | No. 9002

9002

>>8999 |

| >> | No. 9009

9009

>>9002 |

| >> | No. 9011

9011

I've just discovered that 'Living On A Share' hasn't been taken as a handle. I've just registered the twitter and am now going to squat this genius name. |

| >> | No. 9012

9012

Kod.jpg

Kodal Minerals have been granted their lithium mining licence in Mali. |

| >> | No. 9013

9013

Screenshot 2021-11-19 at 17.21.53.jpg

Go Helium One! |

| >> | No. 9014

9014

>>9013 |

| >> | No. 9015

9015

>>9014 |

| >> | No. 9016

9016

>>9015 |

| >> | No. 9048

9048

Various crypto seem to be climbing again, maybe people are buying in anticipation of another New Year's boom like the last. |

| >> | No. 9049

9049

>>8888 |

| >> | No. 9050

9050

>>9049 |

| >> | No. 9051

9051

>>9050 |

| >> | No. 9052

9052

1495__trade__sonic_inflation_by_dragontissdragon_d.jpg

I don't think you lads are on about what I think you are. Are you? |

| >> | No. 9053

9053

>>9051 |

| >> | No. 9054

9054

Come into 50k. I now have savings of... 51k. |

| >> | No. 9055

9055

FALTI-Chart-2-Dec-21.png

>>9054 |

| >> | No. 9056

9056

>>9054 |

| >> | No. 9057

9057

>>9054 |

| >> | No. 9058

9058

A friend asked for some investment advice, so I told them to make an account with Vanguard and to take a look at funds. |

| >> | No. 9059

9059

>>9058 |

| >> | No. 9060

9060

>>9058 |

| >> | No. 9061

9061

>>9060 |

| >> | No. 9062

9062

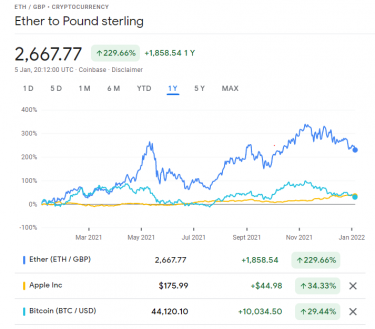

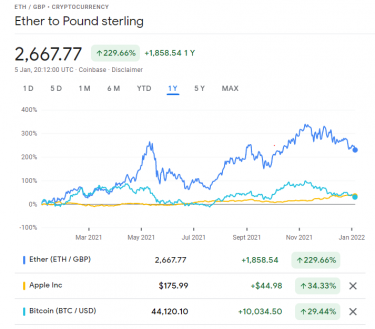

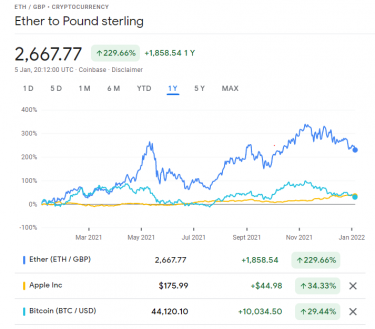

APPLvBTC.jpg

Interesting graph. Bitcoin vs Apple. |

| >> | No. 9063

9063

>>9062 |

| >> | No. 9064

9064

>>9062 |

| >> | No. 9065

9065

>>9063 |

| >> | No. 9066

9066

Lines.png

>>9065 |

| >> | No. 9067

9067

>>9066 |

| >> | No. 9068

9068

>>9067 |

| >> | No. 9069

9069

>>9068 |

| >> | No. 9070

9070

>>9069 |

| >> | No. 9071

9071

>>9070 |

| >> | No. 9072

9072

>>9071 |

| >> | No. 9074

9074

Capture4.png

>>9069 |

| >> | No. 9075

9075

>>9072 |

| >> | No. 9076

9076

>>9075 |

| >> | No. 9077

9077

>>9076 |

| >> | No. 9078

9078

>>9077 |

| >> | No. 9079

9079

>>9071 |

| >> | No. 9080

9080

>>9079 |

| >> | No. 9081

9081

kazakhBTC.png   >>9080 |

| >> | No. 9082

9082

>>9081 |

| >> | No. 9106

9106

H1.jpg

Helium's going back up. |

| >> | No. 9107

9107

>>9106 |

| >> | No. 9108

9108

>>9107 |

| >> | No. 9109

9109

>>9108 |

| >> | No. 9110

9110

>>9106 |

| >> | No. 9111

9111

4mEZQNe.jpg

>>9109 |

| >> | No. 9112

9112

9F33AD1E-76EB-46AE-BE1B-4F259966BBD4.png

Happy about the HE1 here. Shame US tech stocks (Gitlab) are tanking. |

| >> | No. 9113

9113

>>9112 |

| >> | No. 9114

9114

dunningkrugerrands.png

Behold! The dumbest investment on the planet! |

| >> | No. 9115

9115

>>9114 |

| >> | No. 9116

9116

>>9115 |

| >> | No. 9117

9117

>>9116 |

| >> | No. 9118

9118

>>9117 |

| >> | No. 9119

9119

>>9117 |

| >> | No. 9120

9120

>>9117 |

| >> | No. 9121

9121

>>9120 |

| >> | No. 9122

9122

>>9121 |

| >> | No. 9123

9123

>>9120 |

| >> | No. 9124

9124

>>9123 |

| >> | No. 9126

9126

HE1.jpg

I'm telling you lads, helium is going up. |

| >> | No. 9127

9127

>>9126 |

| >> | No. 9128

9128

Are financial advisors worth employing, if you're relatively young (30) and with not much to invest (40k)? |

| >> | No. 9129

9129

>>9128 |

| >> | No. 9131

9131

>>9129 |

| >> | No. 9132

9132

>>9131 |

| >> | No. 9133

9133

>>9132 |

| >> | No. 9134

9134

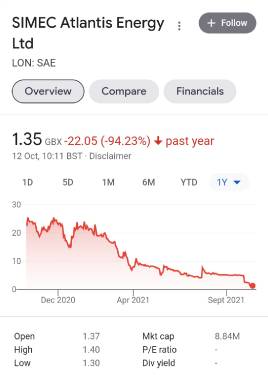

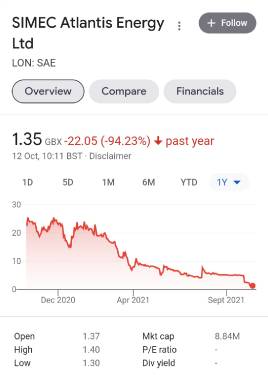

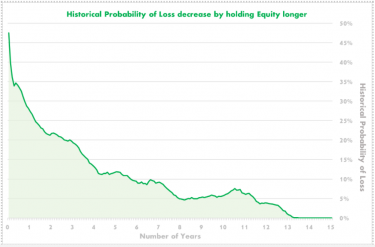

linechart.png

>>9133 |

| >> | No. 9135

9135

>>9133 |

| >> | No. 9137

9137

>>9135 |

| >> | No. 9138

9138

What can I put my modest 6-7 grand of savings in to make sure the impending Weimar Republic levels of hyperinflation don't render it worthless? |

| >> | No. 9139

9139

>>9138 |

| >> | No. 9140

9140

>>9139 |

| >> | No. 9141

9141

>>9140 |

| >> | No. 9142

9142

>>9141 |

| >> | No. 9143

9143

Untitled.png

>>9124 |

| >> | No. 9146

9146

>>9143 |

| >> | No. 9157

9157

linechart.png

Have you lads stuck with tech or have you shifted into more inflation-proofed stocks, like energy companies? |

| >> | No. 9158

9158

>>9157 |

| >> | No. 9159

9159

>>9158 |

| >> | No. 9160

9160

>>9159 |

| >> | No. 9161

9161

>>9160 |

| >> | No. 9162

9162

>>9161 |

| >> | No. 9163

9163

>>9158 |

| >> | No. 9164

9164

>>9160 |

| >> | No. 9165

9165

Lads, I'm currently thinking of moving my stocks and shares from one account to another and doing some rebalancing. The thing is that we're likely due a bounce at some point and as I'm moving large sums that could therefore present a big dent. |

| >> | No. 9166

9166

>>9165 |

| >> | No. 9167

9167

>>9166 |

| >> | No. 9168

9168

I'm going to lose a lot of money today. I will probably lose even more tomorrow. |

| >> | No. 9169

9169

>>9168 |

| >> | No. 9170

9170

>>9169 |

| >> | No. 9189

9189

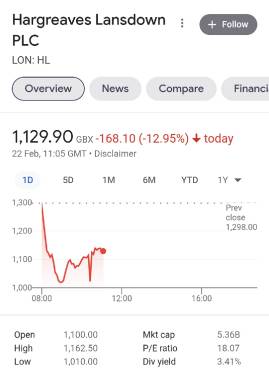

HL.jpg

HL shares are down to their lowest in about seven years off the back of reduced inflows and an announcement to spend about £175m updating their tech and creating some form of robo-advice proposition. |

| >> | No. 9190

9190

>>9189 |

| >> | No. 9191

9191

>>9190 |

| >> | No. 9193

9193

Screenshot_20220303-141324_Chrome.jpg

HL keeps dropping. It's now fallen by over a third in a year. |

| >> | No. 9194

9194

>>9112 |

| >> | No. 9195

9195

>>9194 |

| >> | No. 9196

9196

Made 10% shorting oil in within a few minutes when it was bouncing around 124.5 |

| >> | No. 9197

9197

rub-gbp.png

I briefly considered going long on RUB/GBP last night after yesterday's 30-percent drop, but you really need to have a death wish to trade that currency pair right now as a retail investor. Any more shenanigans from Putin, and you're looking at another 20 to 30 percent slump from one day to the next. |

| >> | No. 9198

9198

>>9197 |

| >> | No. 9199

9199

>>9197 |

| >> | No. 9200

9200

>>9199 |

| >> | No. 9201

9201

>>9199 |

| >> | No. 9202

9202

What's the easiest thing to do with five-digit sums of money in the face of rising inflation? All my money will be worth less if I just leave it in the bank as money. About a third of what I have is already shares in the FTSE 100 and FTSE 250, and surely if inflation keeps going up, then the price of assets such as shares will go up accordingly and I can just leave an extra £20,000 there until I can finally buy a house with it. But people keep saying that bonds are better than shares. However, they pay back less in terms of interest and general return on investment. I guess I could get another 5-10 grand in bonds and then some more shares in another country, but obviously I would like to maximise the Literally Free Money™ that I can get from these, and shares sound like a better idea than bonds from that perspective. |

| >> | No. 9203

9203

linechart.png

>>9202 |

| >> | No. 9204

9204

Bollocks. I've just deposited £100 on T212 with the intention of investing it all in Oatly but it's not even on there. |

| >> | No. 9205

9205

>>9202 |

| >> | No. 9206

9206

>>9205 |

| >> | No. 9207

9207

>>9206 |

| >> | No. 9208

9208

T212.png

>>9207 |

| >> | No. 9209

9209

>>9207 |

| >> | No. 9210

9210

>>9208 |

| >> | No. 9211

9211

>>9210 |

| >> | No. 9212

9212

>>9211 |

| >> | No. 9213

9213

>>9212 |

| >> | No. 9214

9214

>>9212 |

| >> | No. 9215

9215

>>9213 |

| >> | No. 9221

9221

These guys seem cool but not sure if you get a ROI |

| >> | No. 9222

9222

>>9221 |

| >> | No. 9241

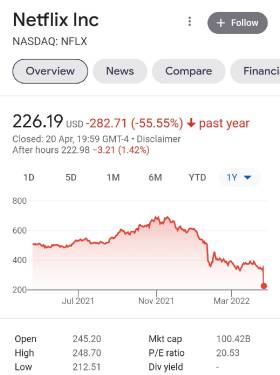

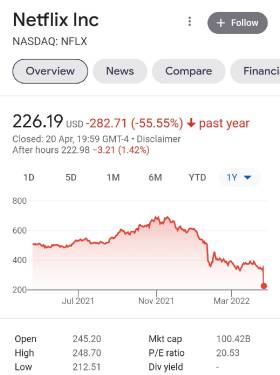

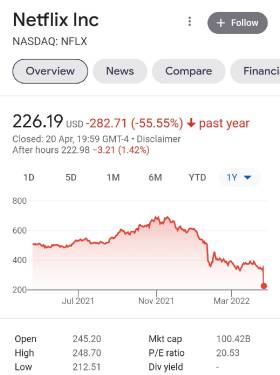

9241

Netflakes.jpg

Take advantage of the Netflix dip or will it keep going down? |

| >> | No. 9242

9242

>>9241 |

| >> | No. 9243

9243

>>9241 |

| >> | No. 9244

9244

>>9243 |

| >> | No. 9245

9245

86exbw1ttou81.jpg   >>9241 |

| >> | No. 9428

9428

I just bought some stock and the price immediately went up by 10%. The price had been stable prior to this for days. The value of my investment has gone down by 10%. I don't understand. |

| >> | No. 9429

9429

How is any of this shit different to gambling? Isn't it easier to just put it on an accy? |

| >> | No. 9430

9430

>>9429 |

| >> | No. 9431

9431

I'm told I might be inheriting around 200k after tax. I don't want to buy a property and I'm not into gambling. How can I use it to generate a small, reliable income supplement? |

| >> | No. 9432

9432

>>9431 |

| >> | No. 9433

9433

>>9430 |

| >> | No. 9434

9434

>>9432 |

| >> | No. 9435

9435

>>9434 |

| >> | No. 9436

9436

>>9435 |

| >> | No. 9437

9437

>>9436 |

| >> | No. 9438

9438

Gene-Takovic-22.jpg

>>9435 |

| >> | No. 9439

9439

>>9438 |

| >> | No. 9440

9440

NGp17SSzHUtUZiR4VnovH6P55nc2EjyqqWXBW3Jwgrg.png

>>9439 |

| >> | No. 9441

9441

Why is it that when I invest in a cheap tracker for a particular index it will always have around 2-5% geographically based outside the market? It seems an odd standard when geolocation tags in investment are typically done by where the company is listing rather than where it has operations. I feel like I'm in too deep to question this but going by have pervasive it has become I can't help but feel there's some funny business going on. |

| >> | No. 9442

9442

>>9441 |

| >> | No. 9443

9443

>>9441 |

| >> | No. 9444

9444

>>9442 |

| >> | No. 9445

9445

>>9444 |

| >> | No. 9450

9450

I've decided to sell all my non-mining punts at a loss to double down on IAG seeing as all our airports are fucked, just over 100 shares bought at £1.2094. |

| >> | No. 9451

9451

>>9450 |

| >> | No. 9452

9452

>>9451 |

| >> | No. 9453

9453

>>9450 |

| >> | No. 9454

9454

>>9450 |

| >> | No. 9455

9455

>>9453 |

| >> | No. 9456

9456

>>9455 |

| >> | No. 9457

9457

>>9455 |

| >> | No. 9461

9461

merlin_149331819_0656d095-16cd-4a34-b581-0c9cc17b5.jpg

S&P500 is now in a bear market and what was supposedly my absolutely secure office is now talking about redundancies. |

| >> | No. 9463

9463

https://www.cnbc.com/2022/06/13/crypto-lender-celsius-pauses-withdrawals-bitcoin-slides.html |

| >> | No. 9464

9464

>>9463 |

| >> | No. 9465

9465

>>9464 |

| >> | No. 9466

9466

>>9465 |

| >> | No. 9467

9467

losses.jpg

Just saw this on CNBC. |

| >> | No. 9468

9468

>>9466 |

| >> | No. 9469

9469

>>9468 |

| >> | No. 9470

9470

>>9469 |

| >> | No. 9471

9471

>>9468 |

| >> | No. 9472

9472

https://www.theguardian.com/technology/2022/jun/18/cryptocurrency-collapse-bitcoin-kim-kardashian-floyd-mayweather |

| >> | No. 9473

9473

LUNC_ALL_graph_coinmarketcap.png   >>9466 |

| >> | No. 9474

9474

>>9473 |

| >> | No. 9475

9475

>>9473 |

| >> | No. 9476

9476

>>9474 |

| >> | No. 9477

9477

>>9476 |

| >> | No. 9478

9478

>>9477 |

| >> | No. 9479

9479

>>9477 |

| >> | No. 9480

9480

>>9478 |

| >> | No. 9481

9481

>>9480 |

| >> | No. 9482

9482

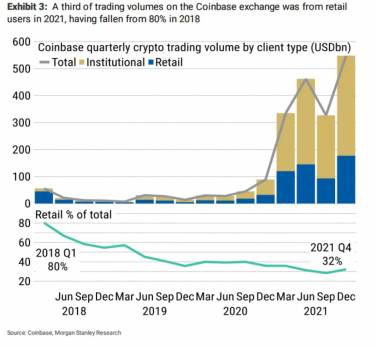

coinbase.jpg

>>9481 |

| >> | No. 9483

9483

>>9482 |

| >> | No. 9484

9484

>>9482 |

| >> | No. 9485

9485

>>9484 |

| >> | No. 9488

9488

https://fortune.com/2022/06/16/lehman-brothers-crypto-crash-celsius-luna-bear-stearns-recession/ |

| >> | No. 9489

9489

>>9488 |

| >> | No. 9490

9490

>>9489 |

| >> | No. 9491

9491

>>9489 |

| >> | No. 9492

9492

>>9491 |

| >> | No. 9493

9493

>>9492 |

| >> | No. 9494

9494

>>9493 |

| >> | No. 9495

9495

>>9490 |

| >> | No. 9496

9496

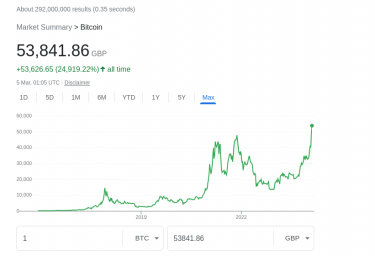

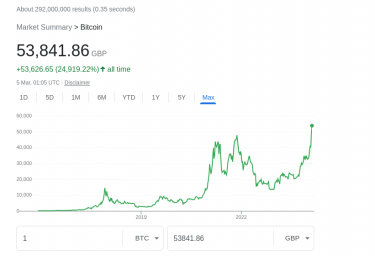

I'm starting to think gs is a reliable indicator: whenever Bitcoin has fallen sufficiently for the nocoiners here to have smug gloat it's the perfect time to take a punt on it. |

| >> | No. 9497

9497

I think the DOW is in for a bit of a multi-day relief rally. Trying to find something like a leveraged ETF on the index to ride it for a couple of days. |

| >> | No. 9498

9498

>>9497 |

| >> | No. 9499

9499

>>9498 |

| >> | No. 9500

9500

>>9499 |

| >> | No. 9501

9501

https://www.cnbc.com/2022/07/04/crypto-lender-vauld-halts-withdrawals-as-market-crash-takes-its-toll-.html |

| >> | No. 9556

9556

Worst day I've had on the markets for years - been doing really well lately, too. Sucks to be me. |

| >> | No. 9557

9557

linechart.png

>>9556 |

| >> | No. 9558

9558

>>9557 |

| >> | No. 9559

9559

>>9557 |

| >> | No. 9563

9563

I bought some Cineworld this morning, against my better judgement. But I've already made money on it, so feeling good. |

| >> | No. 9564

9564

>>9563 |

| >> | No. 9565

9565

>>9564 |

| >> | No. 9566

9566

>>9565 |

| >> | No. 9567

9567

>>9566 |

| >> | No. 9568

9568

>>9567 |

| >> | No. 9569

9569

>>9568>>9567 |

| >> | No. 9570

9570

>>9569 |

| >> | No. 9571

9571

>>9569 |

| >> | No. 9572

9572

It turns out one of my work colleagues has also taken a punt on Kodal. He keeps updating me on what's going on, which tends to drift in one ear and out of the other, but he's adamant that it's going to shoot up at some point before Christmas and that's when he's selling out. |

| >> | No. 9573

9573

>>9572 |

| >> | No. 9574

9574

>>9573 |

| >> | No. 9575

9575

>>9574 |

| >> | No. 9576

9576

>>9575 |

| >> | No. 9577

9577

I've taken a punt and added Tesla and Allianz to my portfolio. Allianz is one of Europe's biggest insurers with a market cap of close to 80 billion euros. That part of the finance industry is set to profit from rising interest rates more than many other businesses. |

| >> | No. 9578

9578

>>9577 |

| >> | No. 9579

9579

>>9578 |

| >> | No. 9580

9580

>>9579 |

| >> | No. 9581

9581

>>9580 |

| >> | No. 9582

9582

>>9579 |

| >> | No. 9583

9583

>>9582 |

| >> | No. 9584

9584

>>9583 |

| >> | No. 9585

9585

>>9584 |

| >> | No. 9586

9586

>>9585 |

| >> | No. 9587

9587

lol.jpg

|

| >> | No. 9588

9588

>>9585 |

| >> | No. 9589

9589

>>9581 |

| >> | No. 9590

9590

>>9589 |

| >> | No. 9591

9591

>>9590 |

| >> | No. 9592

9592

>>9591 |

| >> | No. 9593

9593

>>9592 |

| >> | No. 9594

9594

>>9593 |

| >> | No. 9595

9595

>>9594 |

| >> | No. 9596

9596

>>9594 |

| >> | No. 9597

9597

>>9595 |

| >> | No. 9598

9598

>>9597 |

| >> | No. 9602

9602

There was an investment update from Royal London earlier this month stating that they believe banks are looking like attractive companies to invest in. |

| >> | No. 9603

9603

>>9602 |

| >> | No. 9604

9604

>>9602 |

| >> | No. 9605

9605

>>9603 |

| >> | No. 9606

9606

Also, Kodal have finally had that surge. Not as much as my colleague claimed it would be, but in little over a week it's gone from 0.23p to 0.41p per share. |

| >> | No. 9607

9607

gdr.png

Genedrive (GDR) still have not sold any covid test appliances, but this week the share has surged for no certain reason. Message board chat suggests that there is positive news incoming regarding their appliance to check if babies have a gene that means certain antibiotics will cause permanent hearing loss. |

| >> | No. 9651

9651

vuJpD-DmYAqvD-f1F-kB3niqwQpSjRIPggu2ue_m0hE.jpg

Decided to take my Kodal gains and reinvest them into PREM in the hope its momentum continues. |

| >> | No. 9662

9662

Shares.png   >>9651 |

| >> | No. 9700

9700

IMG_3174.png   The HE1 rollercoaster continues. No news, then news of no rig, then news of a rig! |

| >> | No. 9701

9701

>>9700 |

| >> | No. 9716

9716

>>9651 |

| >> | No. 9717

9717

Bought into Greencoat UK Wind on the off chance we start seeing momentum toward onshore wind. I'll hold the Earth responsible for any loss. |

| >> | No. 9718

9718

>>9716 |

| >> | No. 9719

9719

>>9717 |

| >> | No. 9720

9720

>>9719 |

| >> | No. 9721

9721

Untitled.jpg

>>9720 |

| >> | No. 9722

9722

>>9719 |

| >> | No. 9723

9723

>>9722 |

| >> | No. 9724

9724

>>9723 |

| >> | No. 9725

9725

>>9724 |

| >> | No. 9726

9726

>>9725 |

| >> | No. 9727

9727

>>9726 |

| >> | No. 9728

9728

>>9726 |

| >> | No. 9729

9729

>>9727 |

| >> | No. 9730

9730

>>9729 |

| >> | No. 9731

9731

>>9730 |

| >> | No. 9732

9732

>>9730 |

| >> | No. 9733

9733

>>9731 |

| >> | No. 9734

9734

>>9733 |

| >> | No. 9735

9735

>>9734 |

| >> | No. 9736

9736

>>9731 |

| >> | No. 9737

9737

>>9733 |

| >> | No. 9738

9738

>>9737 |

| >> | No. 9739

9739

>>9736 |

| >> | No. 9740

9740

>>9739 |

| >> | No. 9741

9741

>We’ve made the decision to restrict non-GBP funds where the fund manager applies a foreign exchange commission charge, including those listed above. The fund manager does not offer an equivalent GBP version of the fund. This means that you can continue to hold your existing non-GBP fund but will not be able to make any further purchases of it through our platform. |

| >> | No. 9742

9742

>>9701 |

| >> | No. 9743

9743

>>9742 |

| >> | No. 9744

9744

IMG_0221.jpg  >>9456 |

| >> | No. 9751

9751

barclays.jpg

Thinking about BARC again. It looks undervalued to me at 145.14p with P/E 4.66 and a 5% dividend that's liable to get higher. I might go in at the end of the month - UK banks in general seem undervalued. |

| >> | No. 9752

9752

>>9751 |

| >> | No. 9753

9753

Why can't I pay into two s&s isas in the same year? |

| >> | No. 9754

9754

>>9753 |

| >> | No. 9755

9755

>>9753 |

| >> | No. 9756

9756

>>8124 here. It's £40k now. |

| >> | No. 9757

9757

>>9756 |

| >> | No. 9758

9758

Thinking of going balls deep into the Digital 9 Infrastructure investment trust. |

| >> | No. 9759

9759

>>9758 |

| >> | No. 9760

9760

>>9759 |

| >> | No. 9764

9764

>>9757 |

| >> | No. 9765

9765

>>9764 |

| >> | No. 9771

9771

When will the market stop being a cunt. |

| >> | No. 9772

9772

>>9771 |

| >> | No. 9773

9773

>>9771 |

| >> | No. 9774

9774

There's no fucking way BP should be dumping another -2.2% today as we head into winter. This is madness. |

| >> | No. 9775

9775

rivian.jpg

I'm kicking myself for not selling Rivian stock that I bought for $25 last year. Which seemed like a good discount at the time, and it did go back up to $39 at one point after I bought it, but the last year or so it's only been fluctuating and now it's back to around $16. |

| >> | No. 9776

9776

>>9775 |

| >> | No. 9777

9777

>>9776 |

| >> | No. 9779

9779

>>9777 |

| >> | No. 9780

9780

>>9779 |

| >> | No. 9794

9794

santa-rally.png

Next year, please can PNL.L start doing what it is supposed to, and rise with inflation. Also can the discount be reduced on UK stocks, like Merryn keeps saying it will. |

| >> | No. 9803

9803

fa5.jpg

How on Earth is Amazon still hitting numbers like 6.6% - where is the growth even coming from at this point? |

| >> | No. 9804

9804

>>9803 |

| >> | No. 9805

9805

>>9804 |

| >> | No. 9807

9807

>>9803 |

| >> | No. 9808

9808

1. Tiny AIM company wants to raise some money for another helium drill. |

| >> | No. 9809

9809

>>9808 |

| >> | No. 9810

9810

glenn hodl.png

My cryptocurrency investments, for which I paid approximately £3,700 in total, have just passed £3000 in value for the first time since they plummeted to fuck all. Yippee! |

| >> | No. 9811

9811

Untitled.jpg

>>9717 |

| >> | No. 9812

9812

Screenshot from 2024-03-05 01-07-32.png

>>9810 |

| >> | No. 9813

9813

>>9812 |

| >> | No. 9814

9814

>>9812 |

| >> | No. 9816

9816

gdr.png

>>9809 |

| >> | No. 9818

9818

>>9816 |

| >> | No. 9820

9820

>>9812 |

| >> | No. 9821

9821

>>9820 |

| >> | No. 9822

9822

>>9821 |

| >> | No. 9823

9823

>>9821 |

| >> | No. 9824

9824

>>9823 |

| >> | No. 9825

9825

Do any of you lads have any index ETFs as long-term investments? So far I've only done short-term trading of very minor amounts that I've put in leveraged ETFs. |

| >> | No. 9826

9826

>>9824 |

| >> | No. 9827

9827

>>9823 |

| >> | No. 9829

9829

>>9825 |

| >> | No. 9830

9830

>>9829 |

| >> | No. 9833

9833

>>9830 |

| >> | No. 9836

9836

I've heard a lot of chatter that the markets are going to crash on the 8th, from people susceptible to conspiracy theories. It might be self-fulfilling if a number of people cash out around then, so could be a good buying opportunity. |

| >> | No. 9837

9837

>>9836 |

| >> | No. 9838

9838

>>9837 |

| >> | No. 9839

9839

>>9837 |

| >> | No. 9840

9840

|

| >> | No. 9841

9841

>>9840 |

| >> | No. 9842

9842

>>9841 |

| >> | No. 9843

9843

>>9842 |

| >> | No. 9844

9844

Untitled.jpg

I hope you lot don't like chocolate. |

| >> | No. 9845

9845

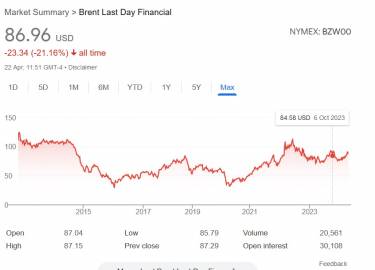

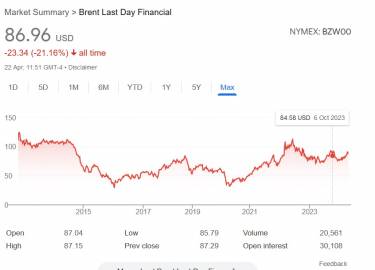

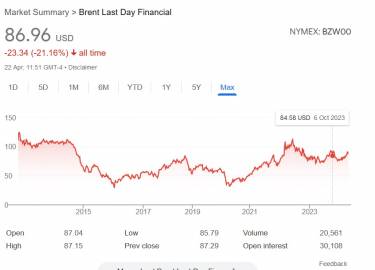

brent-crude.jpg

>>9844 |

| >> | No. 9846

9846

1713865128127871.jpg

>>9845 |

| >> | No. 9854

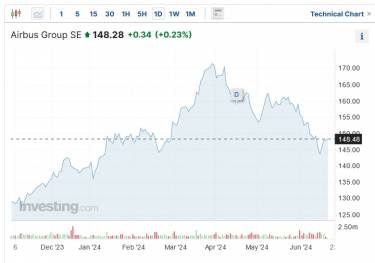

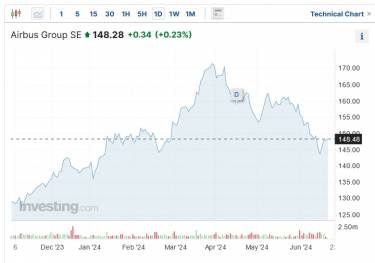

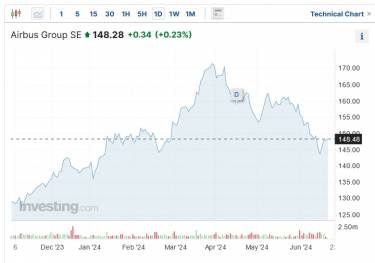

9854

airbus.jpg

Got in on Airbus yesterday hoping to catch the tail end of the bounce. |

| >> | No. 9866

9866

>>9854 |

| >> | No. 9867

9867

My Reddit shares are doing well. |

| >> | No. 9868

9868

Transferred £7.5k from my workplace pension to my SIPP, decided to go for Liontrust UK Micro Cap because I reckon now will be a good time to get into UK smaller companies. Picked that specific fund on a whim though. |

| >> | No. 9869

9869

>>9868 |

| >> | No. 9873

9873

Can someone turn the market on and off again please. I'm currently down 2.8% across my whole portfolio and it's only getting worse. Nikkei just had one of the worst days in its history and is down nearly 6%. |

| >> | No. 9874

9874

>>9873 |

| >> | No. 9875

9875

Nikkei down 12.4%, circuit breakers being hit in South Korea for first time since 2020. ITZ!! |

| >> | No. 9878

9878

Just sold some stocks, with a net profit of 900 quid. Got in on a few Yank stocks at the beginning of the month after the Dow slipped. With September as the statistically worst performing month of the year now looming, it can't hurt to take profit. |

| >> | No. 9884

9884

I'd like to stop losing money now please. |

| >> | No. 9885

9885

>>9884 |

| >> | No. 9886

9886

>>9885 |

| >> | No. 9887

9887

>>9886 |

| >> | No. 9892

9892

Made £600 in 10 minutes this afternoon with a put option on the S&P. Not the kind of degeneracy I normally get mixed up in, but I'm gladly taking those 600 quid or however much it is after fees and tax for some bills that have come up unexpectedly. |

| >> | No. 9893

9893

>>9892 |

| >> | No. 9894

9894

I'm looking to free up a small amount of liquidity for a rental flat move and want to sell an ETF holding for Oz but I'm wondering if submitting an order over the weekend to be fulfilled on Monday morning is the right move. Especially when for the moment I don't have a pressing need. |

| >> | No. 9895

9895

>>9894 |

| >> | No. 9897

9897

>>9893 |

| >> | No. 9898

9898

>>9895 |

| >> | No. 9899

9899

>>9895 |

| >> | No. 9900

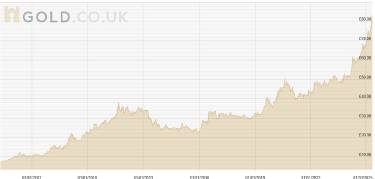

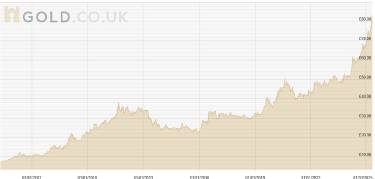

9900

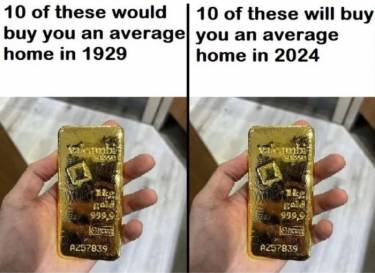

Do you have to declare gold bar purchases? |

| >> | No. 9901

9901

>>9900 |

| >> | No. 9902

9902

gold.jpg

>>9901 |

| >> | No. 9904

9904

gold-price.jpg   >>9901 |

| >> | No. 9905

9905

Feel dumb for failing to pull the trigger on CrowdStrike after their global cockup. |

| >> | No. 9906

9906

I've got £20 in dividends and was thinking of investing this in new stocks. Am I better off investing in index funds instead? I mean the stocks I'm thinking of are basically established companies and would only give a small return. I'm thinking of Marks and Spencer, Rolls Royce and Novartis. |

| >> | No. 9907

9907

>>9906 |

| >> | No. 9914

9914

airbus.jpg   Airbus stock has completely fucked me in the arse since I first got in this spring. I'm considering selling. |

| >> | No. 9915

9915

>>9914 |

| >> | No. 9916

9916

>>9915 |

| >> | No. 9924

9924

Just sold Airbus. Things aren't looking good in the planemaking industry. Airbus is set to post another poor month of deliveries some time tomorrow, and at the end of the month there'll be Q3 earnings, which will probably come with another downgrade of their guidance. |

| >> | No. 9931

9931

Is anyone worried about a tech stock bubble to the point where they might try to reduce their position? |

| >> | No. 9953

9953

Novo Nordisk worth a punt? |

| >> | No. 9954

9954

>>9953 |

| >> | No. 9955

9955

>>9954 |

| >> | No. 9957

9957

>>9905 |

| >> | No. 9970

9970

I'm mainly in European finance and industrial stocks at the moment, and I'm thinking about taking on a hedge by buying an S&P ETF just before the election. |

| >> | No. 9971

9971

This season my play will be robotics and certain agricultural machinery stocks that focus on precision agriculture. |

| >> | No. 9977

9977

pltr.png

Maybe I should have kept my Palantir holding. |

| >> | No. 9978

9978

Bought an S&P 500 ETF the day after the election. Probably should've got in the day before, with the S&P doing the kind of jump that it did. |

| >> | No. 9982

9982

>>9978 |

| >> | No. 9983

9983

Do you reckon now is a good time to invest in American prisons, e.g. Geo Group and Core Civic? |

| >> | No. 9984

9984

>>9983 |

| >> | No. 9985

9985

I'm up on CRSP and already absolutely bricking it. Biotech isn't for me and the ticker is begging for a certain ex-football player to steal my gains. |

| >> | No. 9986

9986

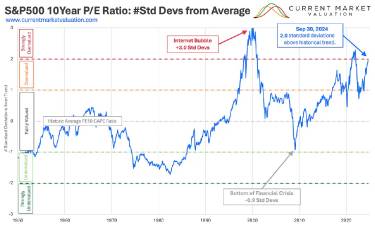

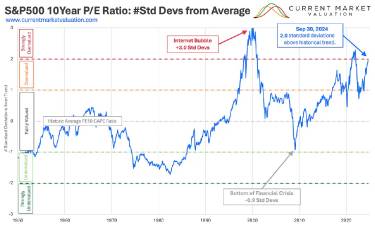

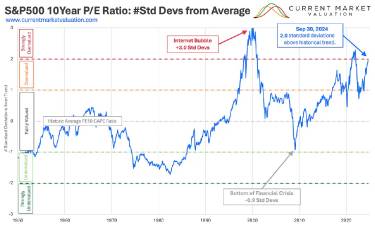

2024-09-30-PE-Chart4.jpg

>>9985 |

| >> | No. 9987

9987

>>9986 |

| >> | No. 9988

9988

FW4HEHGROZDZLGLFNNAX4YD73Q.jpg

>>9987 |

| >> | No. 9989

9989

Bloody bastard Vanguard introducing a £4 per month minimum fee. Guess I'll move to a T212, even if I don't understand how they actually make money. |

| >> | No. 9990

9990

Untitled.jpg

What's the point, lads. You might as well stick it all in the S&P500 and never think about investments ever again. |

| >> | No. 9991

9991

>>9990 |

| >> | No. 9992

9992

>>9991 |

| >> | No. 9993

9993

>>9991 |

| >> | No. 9994

9994

>>9992 |

| >> | No. 9995

9995

hq720.jpg

>>9991 |

| >> | No. 9997

9997

>>9995 |

| >> | No. 10000

10000

ap24353721276791.jpg

Looks like a recession next year is now confirmed by the US Fed. It's a good thing we didn't elect a government that said it would use growth to avoid austerity. |

| >> | No. 10001

10001

The Dow's unusually sharp and consistent decline over the last ten trading days should give ample reason for alarm. It doesn't mean the market as such will crash tomorrow, next week, or in the next few weeks, but it's worth noting that this is the worst losing streak in literally 50 years. Not since 1974 has the index seen back-to-back losses that lasted two weeks. At the time, the stock market was in the middle of the 1973-74 crash, which saw the Dow lose 45 percent. |

| >> | No. 10002

10002

>>10001 |

| >> | No. 10003

10003

>>10001>>10002 |

| >> | No. 10004

10004

>>10003 |

| >> | No. 10005

10005

>>10003 |

| >> | No. 10006

10006

>>10005 |

| >> | No. 10007

10007

>>10006 |

| >> | No. 10008

10008

Dear diary, I very nearly liquidated my entire portfolio this morning for what turned out to be a -1.24% and AMZN and GOOGL even gained value. The next few weeks will be interesting but I'm glad I didn't succumb to the gloom. |

| >> | No. 10009

10009

>>10001 |

| >> | No. 10027

10027

Fire.jpg

Second Monday in a row of a nasty weekend shock where it looks like trade wars weren't priced-in. I'm actually surprised the indices are only averaging a 1-2% loss. |

| >> | No. 10028

10028

>>10027 |

| >> | No. 10029

10029

I'm tempted to pull out of most of my US investments. The S&P500 tracker especially but I suspect I'm just doing it because I don't like the administration and would put a good chunk into Toronto anyway. |

| >> | No. 10030

10030

>>10029 |

| >> | No. 10031

10031

>>10030 |

| >> | No. 10033

10033

Fuck me, gold has gone up. |

| >> | No. 10034

10034

I never noticed before how many bank holidays the US has. Looking it up we're at the bottom of the chart on wikipedia. |

| >> | No. 10036

10036

inflation_1977.jpg

>>10034 |

| >> | No. 10041

10041

>Several lads here seem to have a grasp of investments |

| >> | No. 10042

10042

Do you two reckon the S&P is worth buying again? |

| >> | No. 10043

10043

>>10042 |

| >> | No. 10044

10044

Screenshot_20250315-120814.png

>>10043 |

| >> | No. 10045

10045

I've had some improbable luck trading stock options since last week, and I've made nearly £1,500 just by buying and selling around £5K worth of options each time, and holding them for less than a day. £5K is an amount that I could afford to lose entirely and irretrievably. But I'm still aware that I'm tickling the dragon's tail. And I've been right too many times now, so it's only natural that I'd end up losing if I kept doing it. So I'll stop now. |

| >> | No. 10072

10072

Stock futures are looking grim again. |

| >> | No. 10073

10073

>>10072 |

| >> | No. 10074

10074

>>10073 |

| >> | No. 10075

10075

>>10074 |

| >> | No. 10076

10076

>>10075 |

| >> | No. 10077

10077

Guys why did none of you tell me to buy gold? I'm dying out here... |

| >> | No. 10078

10078

>>10077 |

| >> | No. 10079

10079

What do you reckon the US bottom signals will be. I'm fully out of the US but that's very silly by historical norms so I'm trying to draw a mixture of policy shifts, trade war de-escalation* and improved relative valuation to indicate when the market will roughly pick back up. But it feels like everyone is going to have to go off of vibes on this one. |

| >> | No. 10080

10080

>>10079 |

| >> | No. 10082

10082

>>10079 |

| >> | No. 10083

10083

>>10082 |

| >> | No. 10084

10084

>>10080 |

| >> | No. 10085

10085

>>10084 |

| >> | No. 10086

10086

untitled.jpg   >>10084 |

| >> | No. 10087

10087

>>10086 |

| >> | No. 10088

10088

>>10087 |

| >> | No. 10089

10089

Are you cunts all broke yet? No offence or anything but I would take immense schadenfreude in it. |

| >> | No. 10090

10090

Markets have recovered a lot of ground, at least for my non-US stuff. All feels a bit too bullish to me and I expect some more crashiness later once tariffs and taxes (thanks Rachel) start hitting earnings. |

| >> | No. 10091

10091

>>10090 |

| >> | No. 10092

10092

>>10091 |

| >> | No. 10111

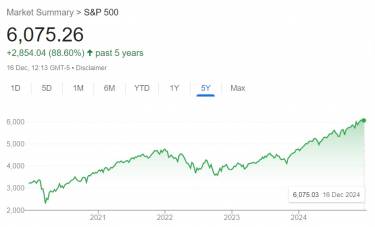

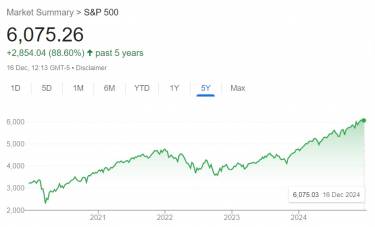

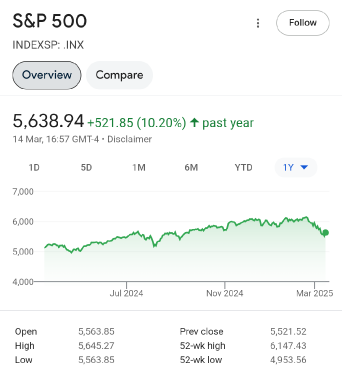

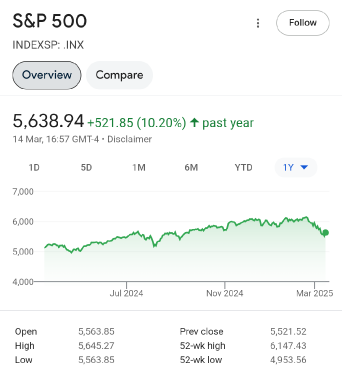

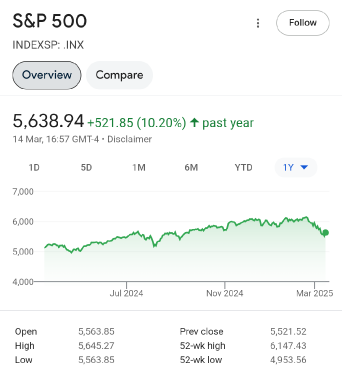

10111

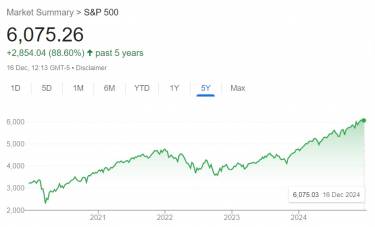

Screenshot_20250516-093047.png

The S&P500 is up year to date. |

| >> | No. 10112

10112

>>10111 |

| >> | No. 10113

10113

>>10112 |

| >> | No. 10114

10114

>>10111 |

| >> | No. 10115

10115

>>10114 |

| >> | No. 10116

10116

>>10115 |

| >> | No. 10117

10117

>>10116 |

| >> | No. 10118

10118

>>10111 |

| >> | No. 10124

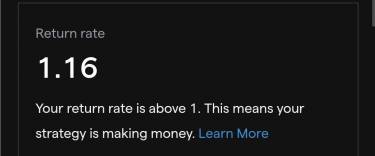

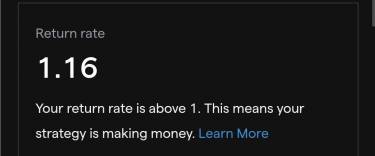

10124

ig.jpg   Is this any good? It's what IG tells me. |

| >> | No. 10125

10125

>>10124 |

| >> | No. 10126

10126

>>10124 |

| >> | No. 10127

10127

>>10126 |

| >> | No. 10128

10128

Tesla was down 14 percent today. |

| >> | No. 10129

10129

>>10128 |

| >> | No. 10130

10130

perth.jpg

The FRDM ETF is exactly what my portfolio needs but I still can't invest in it while it's making more and more growth with a thesis on emerging markets that just makes sense. They're still talking about seed funding for a European equivalent which means we might be years off being able to buy into the idea. |

| >> | No. 10153

10153

Fuck me, gold has gone up. I've got 7.5 ounces of assorted Krugerrand, Maple Leaf and Australian Nugget. |

| >> | No. 10154

10154

>>10153 |

| >> | No. 10155

10155

>>10154 |

| >> | No. 10157

10157

I thought I bought a significant amount of BMW stock this afternoon, because their latest sales report from noon today sounded quite promising. But it was all just smoke and mirrors, because tonight, just hours later, they issued a profit warning and the stock tanked. |

| >> | No. 10158

10158

>>10157 |

| >> | No. 10159

10159

>>10158 |

| >> | No. 10160

10160

>>10158 |

[ Return ] [ Entire Thread ] [ First 100 posts ] [ Last 50 posts ]

|

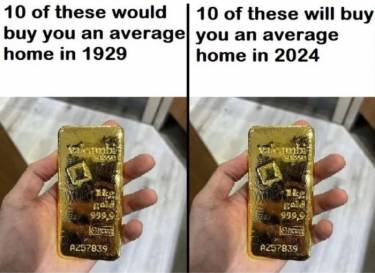

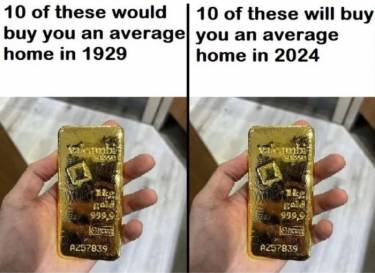

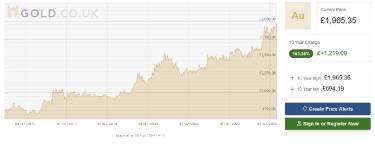

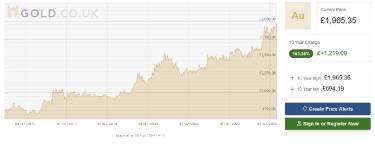

Delete Post [] Password |